If you have ever wondered how to save $10000 in a year, you are not alone. Many people dream of building a solid financial cushion but struggle to find a clear path to get there. The truth is, saving ten thousand dollars in twelve months might sound like a big challenge, but it is absolutely possible with the right plan, mindset, and consistency.

Think of it this way: saving $10000 in a year is not about making huge sacrifices or living on instant noodles. It is about being smart with your money, setting realistic goals, and staying disciplined. Once you learn to control your spending habits and make saving automatic, reaching that goal becomes much easier.

Let us walk through a practical, step-by-step guide that will help you understand exactly how to save $10000 in a year—without feeling overwhelmed.

Why Saving $10000 in a Year Matters

Before you start, it is important to understand why this goal matters. Saving $10000 can change your financial situation in many ways. It can serve as an emergency fund, a down payment for a car or home, or the seed money for starting a small business.

When you set a goal like this, you give your money a purpose. It helps you stay motivated because every dollar you save brings you closer to something meaningful. Financial discipline is not about saying no to life—it is about saying yes to your future.

How to Save $10000 in a Year: Breaking Down the Numbers

Let’s do some simple math. To reach your goal of saving $10000 in a year, you need to set monthly, weekly, or even daily targets.

- If you save monthly: you need to save around $834 per month.

- If you save weekly: that’s about $192 per week.

- If you save daily: you’ll need to put aside roughly $27 per day.

When you break it down this way, it becomes easier to visualize and manage. You do not need to have $10000 lying around; you just need to stay consistent with smaller amounts over time.

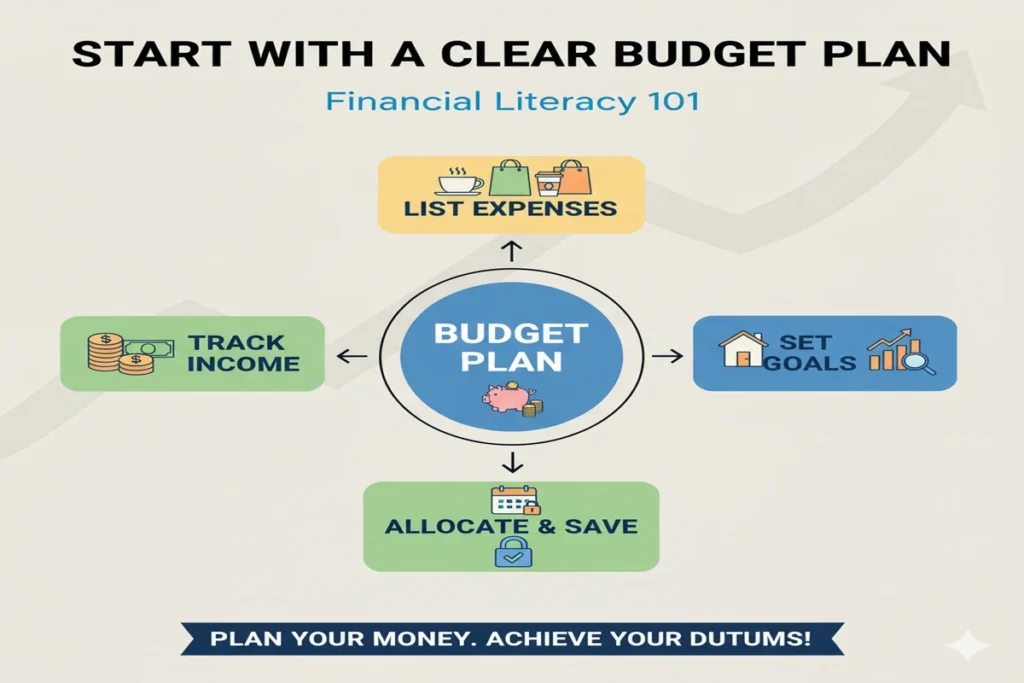

1. Start with a Clear Budget Plan

The first step in learning how to save $10000 in a year is to understand where your money currently goes. A clear budget gives you a complete picture of your income and expenses.

Write down your monthly income and list your expenses under three categories: needs, wants, and savings. Your needs are things you cannot live without—like rent, groceries, transportation, and bills. Wants are the things that bring comfort or pleasure, like dining out, streaming services, or shopping.

Once you see where your money is going, you will notice areas where you can cut back. Even small reductions in your “wants” category can make a big difference when added up over twelve months.

2. Use the 50 30 20 Rule to Stay on Track

One of the easiest budgeting methods to apply while learning how to save $10000 in a year is the 50 30 20 rule. This rule divides your income into three parts:

- 50 percent for needs like rent and food

- 30 percent for wants like entertainment

- 20 percent for savings and debt repayment

Following this rule keeps your spending balanced and ensures that at least 20 percent of your income goes directly toward your savings goal.

3. Automate Your Savings

If you wait until the end of the month to save what’s left, chances are there won’t be much left. That’s why automation is one of the smartest strategies when figuring out how to save $10000 in a year.

Set up an automatic transfer from your main account to your savings account right after payday. This way, you are paying yourself first, and saving becomes a habit rather than an afterthought.

You can also try using digital saving apps or online banking features that allow round-up savings—where every purchase you make is rounded up, and the spare change is transferred into savings. These small amounts can quietly add up over time.

4. Cut Back on Unnecessary Spending

We often spend money on small things that do not add much value to our lives. Whether it is buying coffee every day, eating out too often, or paying for multiple streaming services, these costs can quickly drain your savings potential.

Track your daily expenses for a week. You might be surprised at how much you spend on things that could easily be reduced or eliminated. Cutting back on just $5 to $10 a day could help you reach your save $10000 in a year goal without much pain.

5. Increase Your Income

If your current income barely covers your expenses, saving $10000 in a year may feel impossible. But do not worry—there are ways to increase your income.

You can take a part-time freelance job, sell unused items, or offer your skills online. The extra cash you earn can go directly into your savings fund. Even making an additional $200 per month can get you 20 percent closer to your goal by year-end.

Sometimes, learning how to save $10000 in a year also means learning how to make more money.

6. Avoid Impulse Purchases

Impulse buying is one of the biggest enemies of saving. The excitement of buying something new often fades faster than we expect, leaving us with regret and a smaller bank balance.

A great way to control impulse spending is the “24-hour rule.” Whenever you want to buy something that’s not essential, wait for at least 24 hours before making the purchase. This pause helps you decide if you really need it.

By avoiding unnecessary spending, you naturally create more space for saving and come closer to understanding how to save $10000 in a year effectively.

7. Cook More, Eat Out Less

Food is one of the easiest areas where most people can save money. Eating out frequently adds up quickly, especially if you live in a big city.

Cooking at home not only saves money but also promotes healthier eating habits. Try meal prepping for the week—it saves time and helps you avoid costly takeout. If you spend $15 less each day by eating at home, you’ll save over $450 a month, which is a huge step toward your how to save $10000 in a year goal.

8. Cancel Unused Subscriptions

We live in a world full of monthly subscriptions—music apps, streaming services, magazines, online courses, and gym memberships. The problem is, we often forget we even have them.

Take a look at your bank statement and cancel anything you no longer use regularly. Even cutting two or three $10 subscriptions can help you save $300 to $400 a year effortlessly.

9. Use Cash or Debit Instead of Credit

When you use credit cards, it’s easy to lose track of your spending. Switching to cash or debit forces you to be more aware of your purchases.

If you find yourself asking how to save $10000 in a year but constantly rely on credit cards, try going cash-only for 30 days. You’ll quickly see how much more control you gain over your money.

10. Create a Visual Savings Tracker

Seeing your progress can motivate you to keep going. Create a savings chart or jar where you can track each month’s contribution toward your goal.

When you visually see your savings grow, you’ll feel more inspired to stay on course. This psychological trick keeps you focused on your mission of how to save $10000 in a year without giving up halfway.

11. Build an Emergency Fund

Unexpected expenses are one of the biggest reasons people fail to meet their savings goals. Before putting all your efforts into saving $10000 in a year, build a small emergency fund of $1000 to handle surprises like car repairs or medical bills.

This way, you won’t have to dip into your main savings when life throws you a curveball.

12. Reduce Transportation Costs

If possible, carpool, use public transport, or bike to work a few days a week. Reducing fuel and parking costs can save you hundreds every month.

If you spend $150 less on transportation each month, that alone contributes $1800 toward your annual savings.

13. Shop Smart with Discounts and Cashback

Use coupons, discount codes, and cashback apps whenever possible. Saving 5 to 10 percent on groceries, clothes, and other essentials adds up faster than you think.

If you consistently apply smart shopping habits, you will be amazed at how naturally your balance grows. It’s another simple but effective part of how to save $10000 in a year that people often overlook.

14. Review Your Progress Monthly

Set a reminder to review your savings plan at the end of each month. Check if you’re on track and make adjustments if needed.

If you fall behind one month, you can compensate by saving more the next. What matters most is staying consistent and never losing sight of your end goal.

15. Reward Yourself Along the Way

Saving money doesn’t have to feel like punishment. Reward yourself for hitting small milestones—like saving your first $1000 or $5000. The reward doesn’t have to be expensive; even a small treat or weekend activity can keep your motivation high.

The key to how to save $10000 in a year is balance—enjoying life while managing money wisely.

Mindset Shift: Think Long-Term

Learning how to save $10000 in a year isn’t only about numbers—it’s about mindset. Once you start saving and see progress, you begin to value money differently.

You start asking yourself if each purchase truly matters. You learn patience, self-control, and long-term thinking. These habits are what truly make financial success possible.

Conclusion: You Can Do It

Saving $10000 in a year is not just a financial challenge—it’s a personal transformation. It teaches you discipline, responsibility, and confidence in handling money.

Remember, the key is not perfection but persistence. Even if you miss your monthly target sometimes, what matters is that you keep moving forward. Every dollar saved brings you one step closer to financial freedom.

How to Save $10000 in a Year: Start today, follow the plan, and by this time next year, you’ll proudly look at your bank account and say—you did it.

Related: Financial Literacy 101: Everything You Should Know Before Investing in 2026

Leave a Reply