If someone had told you a few years back that a cinema company would become one of the most discussed and emotionally charged companies on the stock market, you would probably have laughed. After all, AMC Entertainment Holdings is mainly known for popcorn, recliner seats, and weekend movie nights. But in 2021 something wild happened. AMC turned from what many considered a struggling movie chain into one of the most famous names on Wall Street. The reason was simple yet unpredictable. Millions of small independent retail investors decided to challenge traditional market expectations. They believed AMC was more than just a company. They saw it as a symbol, a chance for the little guy to stand up against large hedge funds that were heavily betting against it.

Now you might be wondering, why did all this happen. What exactly drove regular people to unite behind this cinema operator. And is AMC stock still worth looking at today. So let’s sit down like friends chatting over coffee and go through everything in a simple way you can easily understand. I will share the full story of AMC stock, how it became a meme legend, the risks that most people usually do not think about, potential opportunities, current situation, and finally what to consider if you are thinking to invest.

This is a long and detailed conversation, so imagine you and I are talking casually. I will tell you everything without hiding any reality. Let’s begin.

The Story of AMC Before the Drama

AMC Entertainment Holdings was founded long before all these stock battles began. It is one of the largest movie theater chains in the world. With thousands of screens across North America and Europe, AMC has been a go to choice for families, couples, and movie lovers. The company made money mostly from ticket sales, premium formats like IMAX, and food and beverages which is actually a major profit center. If you ever wondered why popcorn costs so much, it is because that is where the cinema makes most of its profit.

Before the pandemic AMC was already burdened with massive debt due to expanding aggressively and upgrading theaters. Then in early 2020 the COVID pandemic hit. Cinemas worldwide shut down and AMC started losing money at record speed. It was on the verge of bankruptcy. Most big investors started short selling the stock, thinking AMC was doomed.

What Exactly Is Short Selling and Why Does It Matter So Much Here

Let me explain short selling in a simple way without financial jargon. Imagine you borrow shares of a company that are priced at 100 dollars. You sell them immediately, hoping that later the stock drops to 50 dollars. Then you buy them back at the lower price, return the borrowed shares, and keep the difference. So you made 50 dollars per share. But there is a big problem. If the stock goes up instead of down, your losses are unlimited. That is why short selling is risky.

In AMC’s case, many hedge funds and institutional investors believed the company was heading towards bankruptcy so they shorted the stock heavily. That meant the number of shares borrowed and sold against AMC’s future success was very high. Retail investors on platforms like Reddit, especially in the now famous forum called WallStreetBets, saw that AMC was one of the most shorted stocks in history. They realized that if they purchased and held the shares, the price could rise, forcing short sellers to buy back shares to close their position, which would increase the price even more. This is known as a short squeeze and that is exactly what they aimed to create.

AMC Stock: How AMC Turned Into a Meme Stock

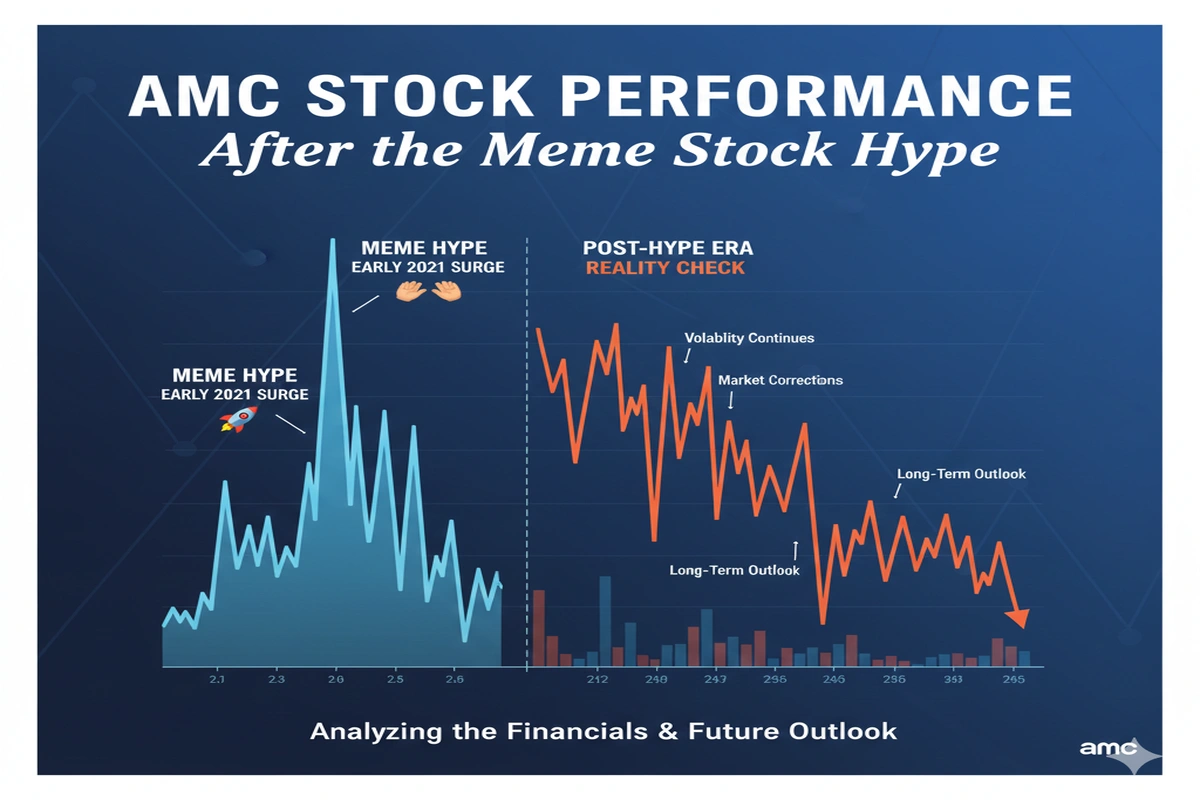

In early 2021, AMC stock price exploded from around 2 dollars to nearly 72 dollars at one point. It was an unbelievable surge caused mainly by retail investors buying and holding passionately. People were sharing screenshots of their portfolios, encouraging each other to hold and not sell. The popular phrase Hold the Line was everywhere. AMC suddenly changed from a struggling cinema chain into what many saw as a movement.

Many investors saw their investments multiply by 10 or even 20 times in a short period. Some made life changing profits. Others got in late and experienced serious losses when the price started fluctuating wildly.

AMC’s CEO Adam Aron quickly adapted to this new reality. He engaged directly with investors on Twitter, called them Apes, and even introduced special benefits like free popcorn for shareholders. AMC used the surge in stock price wisely by issuing more shares to raise billions of dollars in cash to sustain operations. So even though it diluted existing shareholders, it helped AMC avoid bankruptcy.

The Turning Point and What Happened After the Hype

While 2021 was a crazy year for AMC, reality eventually returned. Cinemas reopened but not all movie goers returned in the same way. During the pandemic, streaming services became extremely popular. People started watching new releases from home. Even after theaters reopened, some people preferred staying home.

AMC continued making progress, improving cash flow, and expanding into new areas like selling branded popcorn in supermarkets and even discussing investing in alternative entertainment ventures. But the debt was still large. And financially, AMC was not performing like a healthy growth company.

The share price started declining from its peak but remained significantly higher than what traditional financial evaluations suggested. Some people said that AMC still had potential to grow once people returned to cinemas fully. Some believed streaming platforms would slowly lose momentum. Others said AMC’s financial situation was still weak and that it remained high risk.

Is AMC Stock Still A Meme in 2025

AMC is still considered a meme stock by many traders because it continues to have active retail investor support. There are still those who believe AMC will rise again dramatically if another short squeeze happens. However trading volume and hype are nothing like what they were in 2021. Market conditions have largely stabilized and many large investors and institutions are cautious.

But to be fair there are some improvements. AMC has reduced debt compared to peak levels, although it is still high. Movie releases grew stronger after 2023 with big franchises returning to theaters. Many blockbuster movies contributed to increased foot traffic. But cinema attendance is still not back to pre pandemic levels.

Also interest rates in recent years have increased which makes debt more expensive and affects companies like AMC that rely on borrowing.

Why Some People Still Support AMC

Many retail investors say that AMC is not just a stock but a representation of financial empowerment. They believe that holding the shares shows support for traditional cinema and challenges what they call manipulation by big hedge funds. Some even think that the true number of shorted shares is higher than what official sources report. However that claim has not been officially proven.

At the same time others are investing because they believe that cinema as an experience can never fully die out. Going to the movies is considered a social experience that streaming does not fully replace. AMC is also exploring partnerships such as exclusive releases, events, and advanced premium seating to attract audiences.

Reasons to Be Cautious Before Buying AMC Stock

Now let me talk honestly like a friend. Investing in AMC is still high risk. You might make money if things go very well, but you should be ready for the possibility of losing most or all of your investment if things go wrong.

Here are the main concerns in simple points but explained in paragraph form since you asked to avoid bullet formatting.

AMC has a large amount of debt. It has improved but it is still significant. If business slows down, meeting financial obligations becomes difficult.

Movie theater revenue depends on blockbusters and consumer spending. If major studios decide to release more films directly to streaming platforms or if there are delays like during the Hollywood strike, AMC’s revenue suffers.

Competition from streaming platforms remains strong. Many people now have large TVs, home theater systems, and subscription services that make watching movies at home more convenient.

Its stock price is heavily influenced by emotional trading rather than pure fundamentals. This can make it extremely volatile. You might wake up one day and see a big drop or sudden rise without any major company updates.

AMC still has passionate followers but most of the hype has cooled down since the 2021 surge. New investors might not experience the same dramatic price action.

Reasons Some Investors Still Believe

At the same time it is also important to understand the positive side. AMC has survived what looked like a certain collapse during the pandemic. That shows strong adaptability and resilience. They have found additional revenue sources like expanding concession business outside theaters. They are also exploring live events streaming in cinemas such as sports or concerts which might attract a different audience.

If major studios push back towards exclusive theatrical releases before streaming, cinema visit patterns might improve significantly.

If debt continues to reduce and revenue grows due to better content releases, AMC might slowly strengthen.

If a future short squeeze happens, temporarily driven by retail enthusiasm, prices might jump sharply, but this is highly unpredictable.

Should You Invest in AMC Today

Now this is where we talk like honest friends. If you are planning to invest in AMC today, ask yourself a few questions.

Are you comfortable with extreme volatility. Are you okay if the price suddenly drops fifty percent or more without any warning. Are you investing money you can afford to lose if things do not go as planned. Are you investing because you believe in the company’s long term fundamental growth or are you hoping for another sudden meme wave.

If you are looking for steady growth and low risk, AMC might not be the best option. But if you understand the risks well, believe in the company’s recovery or are intentionally taking a high risk for potential high return, then you could allocate a small portion of your portfolio, not your full investment.

Think of it like this. If you would feel terrible and stressed if AMC drops heavily, do not invest. But if you are fine treating it like a high-risk bet while being fully aware of the dangers, then you can go ahead but carefully.

AMC Stock vs Other Entertainment Investments

AMC is very different from traditional stable companies. For comparison, companies like Disney have diversified businesses including streaming platforms, theme parks, and merchandise. Netflix is completely digital with strong customer base. AMC mainly depends on cinema business which faces pressure from digital alternatives. That is why investors consider AMC as high risk compared to those companies.

However AMC’s stock can deliver big movement in shorter time frames because of its history of retail trading and high short interest levels. That is why traders sometimes prefer AMC for short term trades although it is not advisable without strong technical analysis knowledge.

What the Future Might Look Like for AMC

The best case scenario for AMC is to continue reducing debt, bring in better revenue through consistent blockbuster movie releases, and attract new strategic partnerships. If streaming platforms reduce their early release windows and people return to theaters more frequently, AMC could recover further financially.

AMC has a loyal customer base. Many people prefer the immersive experience of watching movies on the big screen with powerful sound effects. They are also working on enhancing customer experiences with luxury seats, customized food offerings, and even introducing private screening options.

The challenge is sustainability. Can they keep improving without relying on another meme-driven stock price surge. Can they find new ways to increase revenue beyond just selling tickets and popcorn.

Some investors believe the future might become brighter if AMC enters the gaming or live streaming event industry. Others hope for a merger. There have been rumors at times but nothing official yet.

AMC Stock: Lessons We Can Learn From AMC’s Stock Journey

AMC has taught the world that retail investors are powerful when they act collectively. It showed that financial markets are not always controlled only by institutions. It reminded everyone that sometimes the emotional belief of people can move prices more than traditional calculations.

However it also showed that volatility cuts both ways. Some made fortunes and some lost their savings. Emotional trading without understanding the risks can be disastrous.

The most important lesson is that hype does not replace fundamentals in the long term. Eventually a company must prove its worth through real financial performance.

Final Thoughts Like A Friend Telling You Straight

AMC was one of the most dramatic stories in stock market history. Its journey from near collapse to global attention has been fascinating. Today it remains a topic of interest but reality is more balanced. Investing in AMC is still risky but not impossible. You just need to be clear with yourself on your reasons.

If you are buying it hoping for another viral wave you should remember that history rarely repeats exactly. If you are buying it because you believe the cinema industry will thrive again, then consider it as long term and think carefully about how much you invest.

Make sure you research well, check current price, evaluate debt levels and upcoming movie release calendar. And yes, if you invest, keep your emotions under control. Do not get too excited if the price suddenly rises and do not panic if it drops. Only invest what you can afford to lose.

Think of AMC like a roller coaster. Some people love the thrill. Some people get dizzy and never want to ride again. Just decide which one you are.

That was a long chat and I hope you feel more informed now. If you want we can explore next topics like how to analyze stock fundamentals, how to pick high potential stocks early, top movie releases that can impact cinema stocks, or even how meme stocks affect the financial market’s future. Just let me know.

Because at the end of the day, the best investment is made when you fully understand what you are doing and not just because someone else said it is cool.

FAQs

1. Why did AMC stock become so popular?

AMC stock gained massive attention in 2021 when retail investors attempted to trigger a short squeeze against hedge funds that heavily shorted the stock. It quickly turned into a symbol of financial activism.

2. Is AMC still considered a meme stock in 2025?

Yes, AMC still has retail investor support and periodic trading volatility, but the hype has reduced since 2021. Market movement today is more influenced by earnings and business recovery.

3. Can AMC stock rise again like in 2021?

It is unlikely for AMC to repeat the same explosive surge unless extreme trading volume and high short interest return. Current price movements are more tied to actual revenue, cinema attendance, and debt reduction.

4. Is AMC a risky investment?

Yes, AMC remains high risk due to significant debt and strong competition from streaming platforms. It may perform better if movie theaters regain popularity, but investors should only use money they can afford to lose.

5. What could help AMC financially recover?

Strong blockbuster releases, improved cinema attendance, reduction of debt, strategic partnerships, and possible expansion into live events or entertainment offerings could help AMC recover.

6. How could upcoming movies impact AMC stock?

If upcoming films generate high ticket sales and drive audiences into theaters, AMC revenue may increase significantly, improving investor sentiment and possibly affecting stock price positively.

Top Upcoming Movies That Can Impact AMC’s Revenue

These major releases could significantly improve cinema traffic (depending on release schedule):

| Movie Title | Franchise | Potential Impact |

|---|---|---|

| Avengers Secret Wars | Marvel | Massive box office expectations |

| Deadpool 3 | Marvel | High hype among young audience |

| Avatar 3 | James Cameron | Global high ticket sales |

| Fast and Furious 11 | Universal | Strong action fanbase |

| Star Wars New Trilogy | Disney | Huge return of fans |

| Inside Out 3 | Pixar | Family-friendly blockbuster |

| Mission Impossible Next Chapter | Paramount | High theater preference |

| The Batman Part II | DC | Popular especially with IMAX |

If these movies perform well in theaters instead of streaming-first release, AMC could see a meaningful boost in attendance and revenue.

Comparison Table: AMC vs Netflix vs Disney

(Use this inside the article, preferably after discussing AMC risks and competitors)

| Feature / Aspect | AMC Entertainment (AMC) | Netflix (NFLX) | Disney (DIS) |

|---|---|---|---|

| Business model | Cinema theaters and concession sales | Streaming service | Movies, streaming, theme parks, merchandise |

| Revenue source | Ticket sales, food, premium seating | Subscription fees | Media networks, parks, films, merchandise |

| Impact of streaming | Negative (reduces cinema visits) | Positive (main business) | Mixed (Disney+ vs theatrical release strategy) |

| Debt level | High | Moderate | High but manageable |

| Dependency on movie releases | Very high | Low | High for theaters but Disney also earnings from streaming |

| Long-term growth outlook | High risk, recovery dependent | Strong, global expansion | Strong, multi-business diversification |

| Market perception | Meme stock, high volatility | Growth tech stock | Stable entertainment conglomerate |

| Investor type | High-risk traders | Growth investors | Long-term and dividend investors |

| Biggest challenge | Competition from streaming & debt | Content costs & competition | Balancing streaming with theater releases |

| Best-case scenario | Blockbusters boost AMC revenue | Subscriber growth | Hit movies and theme park revenue |

| Worst-case scenario | Decline in cinema demand | Churn and content slowdown | Fewer movie hits and weak streaming profits |

How to Save $10000 in a Year: A Realistic Guide to Reach Your Goal

Leave a Reply