You open your credit card statement and feel frustrated. You paid money last month, but your balance hardly moved — or worse, it increased.

You might wonder: Why is this happening?

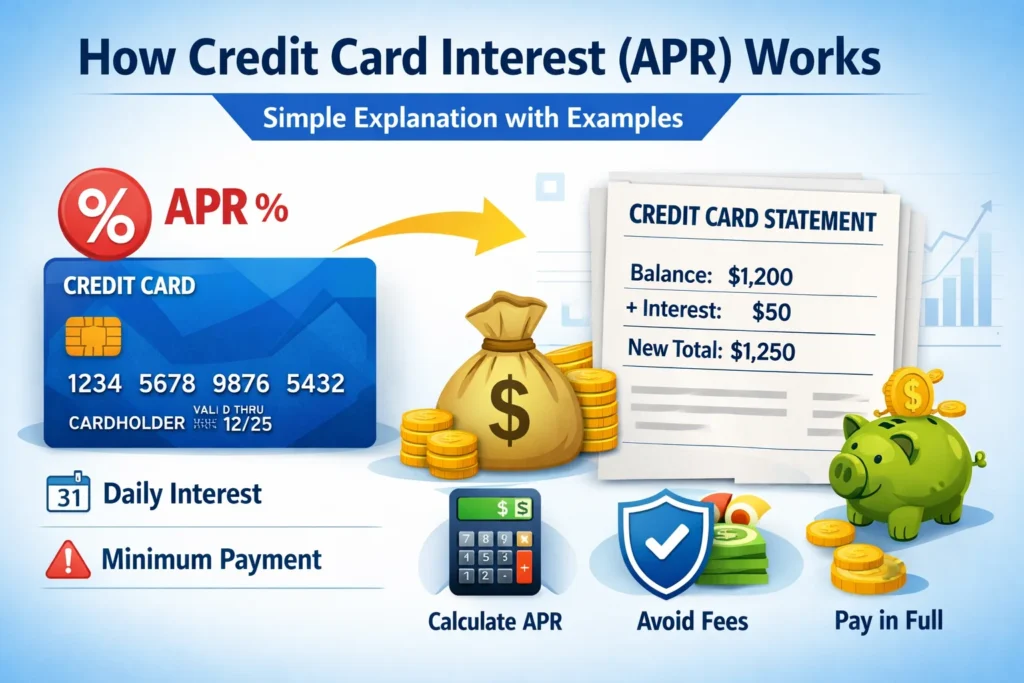

The answer is credit card interest, often called APR (Annual Percentage Rate). Many people misunderstand it, even seasoned card users.

Whether you live in the United States, Canada, or Europe, understanding APR can save you hundreds or even thousands every year.

In this article, we’ll explain exactly how credit card interest works, with real examples and practical tips, so you can stay in control of your money.

1️⃣ What Is Credit Card APR? (Annual Percentage Rate Explained Simply)

APR stands for Annual Percentage Rate.

It is the yearly interest rate your card issuer charges if you don’t pay your full balance by the due date.

Here’s the tricky part: while APR is listed as a yearly rate, credit card interest is often calculated daily. This means interest compounds every day, making small balances grow faster than you might expect.

2️⃣ How Is Credit Card Interest Calculated? (Step-by-Step Example)

Credit card interest may sound complicated, but it’s actually simple once you see it in action.

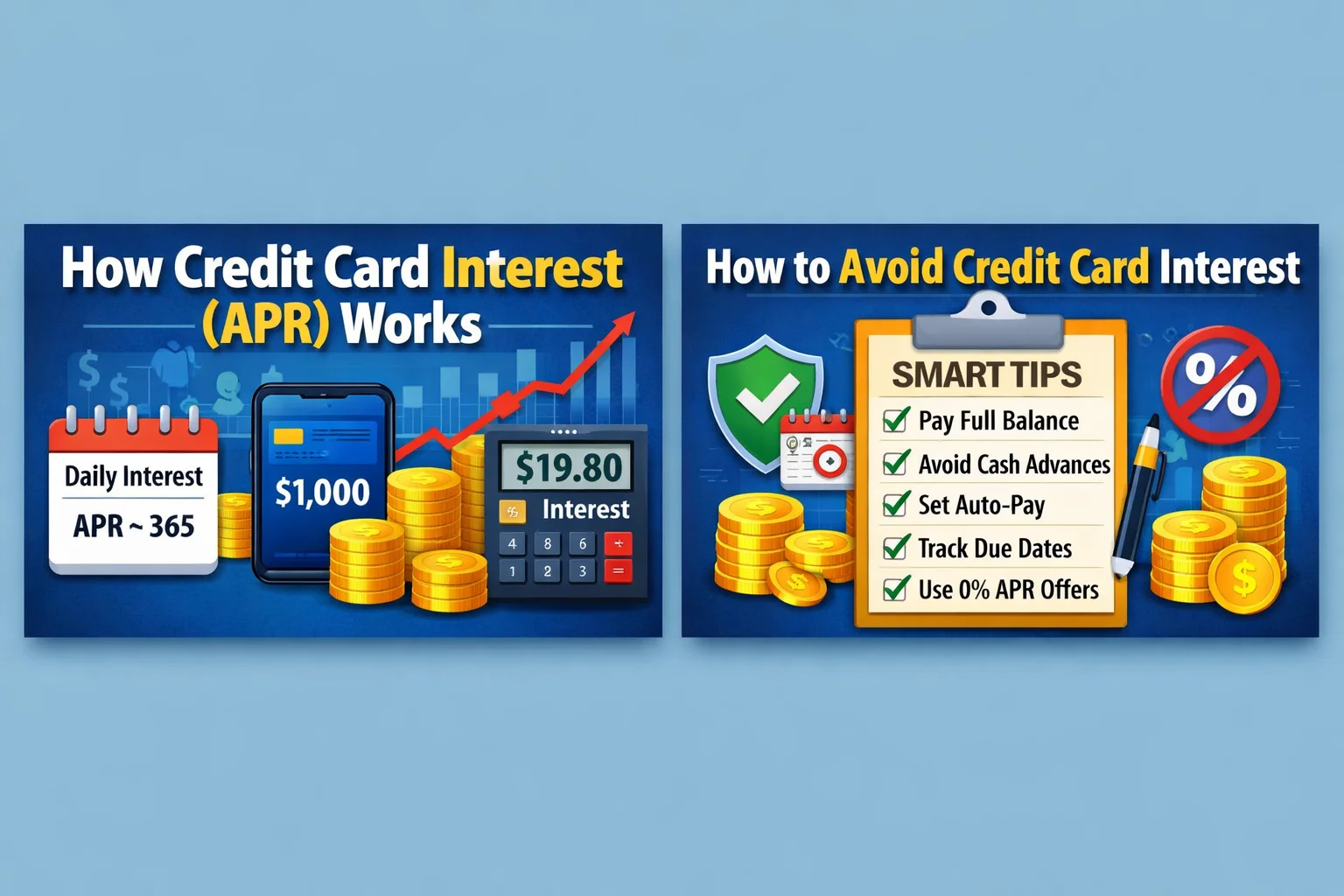

Step 1: Convert APR to daily interest

APR ÷ 365 = Daily Interest Rate

Example:

- Balance: $1,000

- APR: 24%

- Daily rate: 0.0657%

Step 2: Calculate daily interest

$1,000 × 0.0657% ≈ $0.66 per day

Step 3: Calculate monthly interest

$0.66 × 30 ≈ $19.80

If you only make the minimum payment, most of it goes to interest, not your balance. That’s why debts can feel never-ending.

3️⃣ What Are the Different Types of Credit Card Interest?

Credit cards can have multiple APRs depending on usage. Understanding each type can save money.

✅ Purchase APR

- Applies to everyday purchases like shopping or subscriptions.

- Usually, if you pay your full statement balance, you avoid interest completely.

⚠️ Cash Advance APR

- Applies when you withdraw cash from an ATM or transfer cash using your card.

- Higher than purchase APR and starts immediately — no grace period.

🚨 Penalty APR

- Triggered by missed or late payments.

- Can remain active for months or years.

- Common in the US and Canada.

4️⃣ Why Are Minimum Payments Dangerous? (Here’s What Happens to Your Balance)

Credit card companies allow minimum payments to keep your account active.

But here’s the catch:

- Most of the minimum goes to interest first

- Only a small portion reduces your principal

- Debt can last years

Example:

You owe $1,000, make a $50 minimum payment, and your balance barely decreases. Interest continues to pile up, often costing double or triple the original amount.

5️⃣ What Is a Grace Period on Credit Cards? (How to Avoid Interest Completely)

A grace period is the time between your statement closing date and the payment due date.

- Paying the full balance during this period avoids interest.

- Grace periods mainly apply to purchases; cash advances usually have no grace period.

- Missing a full payment can temporarily cancel your grace period.

6️⃣ How to Avoid Paying Credit Card Interest (7 Proven Tips)

- Pay your full statement balance every month

- Avoid cash advances completely

- Set up automatic payments

- Track your statement closing date

- Use 0% APR offers carefully

- Keep balances low to reduce compounding

- Understand your card’s terms and fees

Following these strategies puts you in control and keeps interest from draining your money.

7️⃣ How Credit Card Interest Differs: US vs Canada vs Europe

Although the structure is similar worldwide, some differences exist:

- United States: Higher APRs, more reward-focused cards, more penalty fees

- Canada: Slightly lower APRs, similar interest calculation

- Europe: Lower APRs on average, stricter approvals

Despite these differences, the basic rules of APR apply everywhere.

8️⃣ Common Myths About Credit Card Interest (Debunked)

- ❌ “Interest is charged monthly” – actually, it’s often daily

- ❌ “Minimum payment protects me” – it mostly protects the issuer

- ❌ “One late payment doesn’t matter” – it can trigger penalty APR

- ❌ “APR doesn’t matter if I earn rewards” – rewards are meaningless if interest wipes them out

Knowing the truth saves money.

9️⃣ Key Takeaway: How to Use Credit Cards Wisely Without Paying Extra Interest

Credit cards are powerful tools — when used correctly.

- Paying full balances prevents interest

- Understanding APR gives control over your finances

- Smart habits save you hundreds to thousands annually

Tip: Treat your credit card like a financial tool, not free money.

Q&A

Q: What is credit card APR?

A: APR (Annual Percentage Rate) is the yearly interest rate charged on unpaid credit card balances, calculated daily to compound over time.

Q: How is credit card interest calculated?

A: Credit card interest is calculated using: Daily rate = APR ÷ 365. Multiply daily rate by balance each day to get daily interest, then sum for monthly interest.

Q: How can I avoid paying credit card interest?

A: Pay the full statement balance on time, avoid cash advances, track your due dates, and set up automatic payments to prevent interest charges.

Q: What is a grace period on a credit card?

A: A grace period is the time between your statement closing date and payment due date. Paying in full during this period avoids interest on purchases.

Q: Why are minimum payments dangerous?

A: Minimum payments cover mostly interest, leaving your principal largely untouched. This makes credit card debt last longer and cost more.

Read also: Lifestyle Inflation Explained: Why Raises Don’t Make You Rich

Investment Guide for GCC Professionals: How to Grow Your Money Smartly

Leave a Reply