Best Credit Cards for Bad Credit in 2026 – Rebuild Your Credit Score Fast

If your credit score isn’t where you want it to be, don’t worry. I am here to walk you through this journey like a friend who understands the struggle. Getting approved for a card when your score is low feels stressful, but the good news is that there are practical solutions. In this article, we will discuss the Best Credit Cards for Bad Credit, how they work, how to apply confidently, and how to use them responsibly to rebuild your financial standing.

This guide is written in simple, easy-to-understand language. I will not overwhelm you with complicated terms. By the end, you will know exactly which card suits your situation and how to use it to repair your credit step by step.

Best Credit Cards for Bad Credit – Why This Matters in 2026

Before choosing the Best Credit Cards for Bad Credit, understand that your credit score influences loan approvals, housing opportunities, and even job prospects at times. In 2026, financial institutions will use advanced AI for credit checks, meaning small mistakes can impact approvals quickly.

But there is hope. Many companies now design cards specifically to help individuals rebuild credit.

Types of Credit Cards for Bad Credit

When selecting the Best Credit Cards for Bad Credit, consider these three types:

Secured Credit Cards

These require a refundable deposit, usually between $200 and $500. If you use them responsibly, they upgrade to unsecured cards.

Unsecured Cards with Easy Approval

No deposit but often higher interest. Best for those with slightly better scores.

Store Cards (Retail Cards)

Easier to access but limited usage. Some do not report to all credit bureaus.

Top 7 Best Credit Cards for Bad Credit in 2026

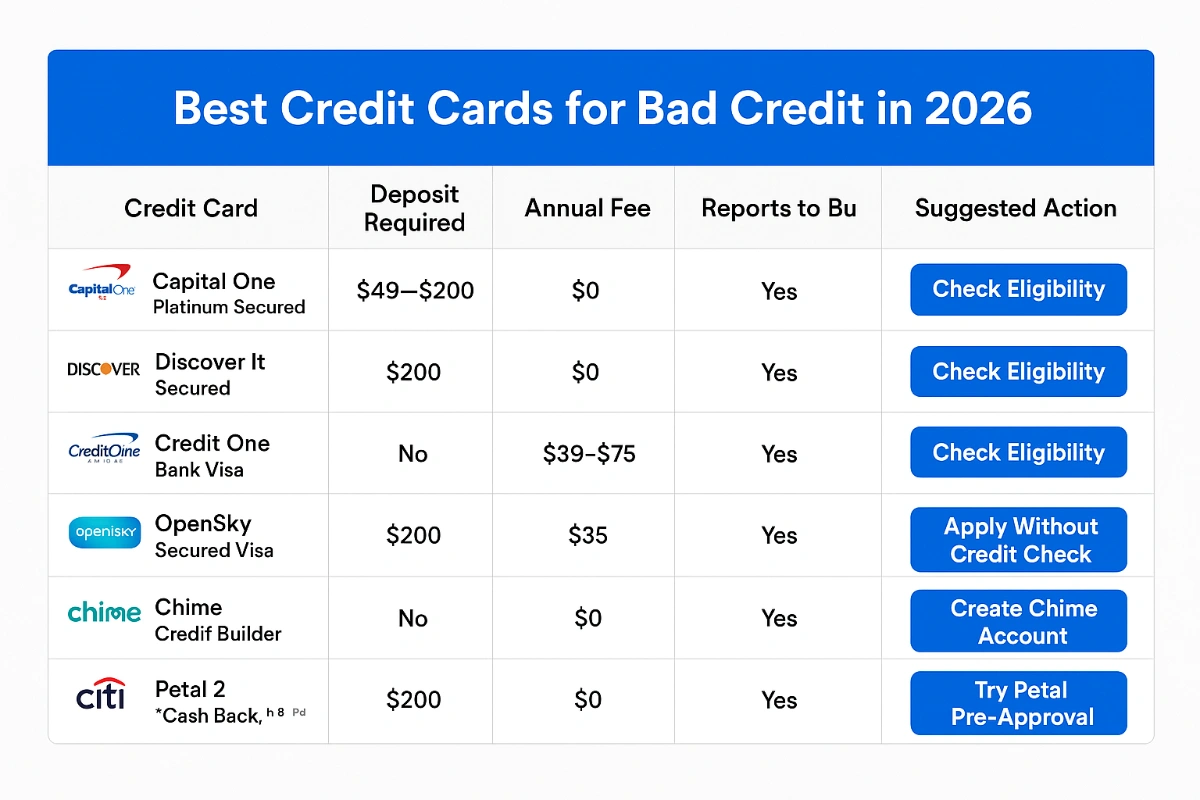

| Credit Card | Deposit Required | Annual Fee | Reports to Bureaus | Suggested Action |

|---|---|---|---|---|

| Capital One Platinum Secured | $49–$200 | $0 | Yes (All) | Check Eligibility |

| Discover It Secured | $200 | $0 | Yes (All) | Check Eligibility |

| Credit One Bank Visa | No | $39–$75 | Yes | Check Eligibility |

| OpenSky Secured Visa | $200 | $35 | Yes | Apply Without Credit Check |

| Chime Credit Builder | No | $0 | Yes | Create Chime Account |

| Citi Secured Mastercard | $200 | $0 | Yes | Check Eligibility |

| Petal 2 “Cash Back, No Fees” Visa | No | $0 | Yes | Try Petal Pre-Approval |

How to Apply for the Best Credit Cards for Bad Credit

When applying for the Best Credit Cards for Bad Credit, follow these steps:

- Check your latest credit score.

- Start with secured cards if score is below 580.

- Compare terms, fees, and upgrade possibilities.

- Apply through online pre-approval to avoid hard inquiries.

Strategies to Improve Approval Chances

- Maintain low credit utilization (below 30%).

- Pay at least the minimum payment on time.

- Clear any collection accounts if possible.

- Avoid applying for multiple cards within 30 days.

Tips to Rebuild Your Credit Score Fast

Use the Best Credit Cards for Bad Credit wisely by:

- Making small purchases and paying full balance monthly.

- Setting payment reminders.

- Keeping accounts active for longer.

- Avoiding cash advances unless urgent.

Ready-to-Use Image Suggestions

1. Credit Card Comparison Chart (Use Alt: “Best Credit Cards for Bad Credit Comparison 2026”)

2. Credit Score Improvement Graph (Use Alt: “How Best Credit Cards for Bad Credit Help Rebuild Score”)

FAQ – Best Credit Cards for Bad Credit

Can I get a credit card with bad credit and no deposit?

Yes, some unsecured cards offer approval even with bad credit.

How long to rebuild credit?

With responsible use of the Best Credit Cards for Bad Credit, improvement can be seen within 3–6 months.

Does applying hurt my credit?

Pre-approval checks do not harm your score. Final approval may use a hard pull.

Final Thoughts – Which Card Is Right for You?

If you need a straightforward card to start rebuilding quickly, the Capital One Platinum Secured or Discover It Secured is ideal. If you prefer no deposit, consider the Chime Credit Builder or Petal 2. Use your card responsibly and within a few months, your credit health can improve significantly.

The journey might feel slow in the beginning, but each positive step will help you move closer to financial freedom. If you genuinely follow the advice shared in this guide about the Best Credit Cards for Bad Credit, your future credit opportunities will grow stronger with time.

How Long Does It Take to See Results After Using the Best Credit Cards for Bad Credit?

If you are using one of the Best Credit Cards for Bad Credit and managing it wisely, you can expect to notice small improvements in your credit score within 90 days. Significant progress generally happens between 6 to 12 months. Many users start seeing opportunities for better credit card upgrades or lower loan interest rates once their score crosses 620.

Remember, your score won’t improve just because you received a card. You must use it consistently and correctly. Here are realistic timeframes:

- 1–3 months: Initial score adjustment once the card reports your payments.

- 4–6 months: Noticeable improvement if balances stay low.

- 6–12 months: Potential upgrade from secured to unsecured card.

- 12+ months: Strong credit rebuild, access to lower APR cards and better financial products.

Common Mistakes to Avoid When Using the Best Credit Cards for Bad Credit

Even if you get one of the Best Credit Cards for Bad Credit, making common mistakes can stop your score from improving or even make it worse. Below are mistakes to avoid at all costs:

- Carrying high balances (over 30% utilization).

- Paying only minimum payments for long periods.

- Missing a payment or paying late.

- Applying for multiple cards within a short period.

- Closing old accounts abruptly.

One missed payment can delay your credit rebuild journey by six months or more. So even if you are going through financial challenges, paying the minimum amount before the due date is better than skipping a payment.

Financial Habits to Practice with the Best Credit Cards for Bad Credit

Here are practical habits you should start immediately:

- Use only 10–20% of your available limit. If your secured card has a $200 limit, try to use only $20–$40 at most.

- Pay off your balance every month. Don’t let it carry over.

- Set automatic payments. This ensures you never pay late.

- Avoid impulse and unnecessary purchases.

- Check your credit report every 60 days. Track progress.

How the Best Credit Cards for Bad Credit Help Improve Your Credit Mix

One key factor affecting credit score is the variety of accounts you hold. This includes loans, credit cards, and installment payments. If you’ve only used cash or debit cards before, using one of the Best Credit Cards for Bad Credit adds positive revolving credit history. Lenders want to see how well you manage debt, and a properly handled credit card confirms reliability.

Second Recommended Image (Use With SEO)

Here’s the suggestion for your second image:

- Image Title: Credit Score Growth Using Best Credit Cards for Bad Credit

- File Name: credit-score-improvement-best-credit-cards-bad-credit.png

- ALT Text: Graph showing how using the Best Credit Cards for Bad Credit improves credit score over 12 months

- Caption: Estimated credit score improvement timeline when using a responsible card strategy.

This image helps readers visually understand progress and improves SEO value.

How to Check Your Credit Score for Free

Before applying for any of the Best Credit Cards for Bad Credit, it’s smart to know your score. In the US, you can check your credit score for free from:

- AnnualCreditReport.com (Official Free Report)

- Credit Karma (Free Score Monitoring)

- Experian’s free account

Checking your score regularly does not impact your credit. Only credit applications do.

Alternative Ways to Build Credit if You Can’t Get a Card

If for any reason you do not qualify for even the Best Credit Cards for Bad Credit, there are still ways to build credit:

- Become an authorized user on a relative’s or friend’s card (with high trust).

- Use rent or utility payment reporting services.

- Apply for a credit-builder loan from a credit union.

- Use responsible installment purchase apps that report to bureaus.

Case Study: How Mark Improved His Credit Using the Best Credit Cards for Bad Credit

Mark, a 36-year-old from Texas, was struggling with a 530 credit score after losing his job in 2023. He applied for a secured card with a $200 deposit. Each month, he spent only $25 and paid it off completely. After four months, his score increased to 582. He kept the habit and by month nine, his credit score crossed 620. By the 10th month, his bank upgraded his secured card to an unsecured version.

This practical example shows how consistent use of the Best Credit Cards for Bad Credit can open up new opportunities.

Frequently Asked Additional Questions

Do all secured cards upgrade?

No. Some secured cards never transition to unsecured automatically. Research your card’s terms before applying.

Is it safe to keep a credit card open even if I don’t use it?

Yes. Keeping cards open for longer improves credit age. Just avoid inactivity fees if mentioned.

Can I increase my credit limit?

Once you prove responsibility, most issuers allow limit increase after six months.

Should I avoid cards with high APR?

Yes for carry-over balances, but if you plan to pay in full monthly, APR should not impact your usage.

Final Recommended Strategy for Using the Best Credit Cards for Bad Credit

Here’s a step-by-step strategy you can follow starting today:

- Check credit report and correct errors.

- Apply for one secured or low-risk unsecured card.

- Use the card for small purchases only (e.g., gas, mobile recharge).

- Pay full balance before due date.

- Maintain this routine for at least six months.

- Request card upgrade or limit increase.

- Keep spending low even once upgraded.

Conclusion – Your Journey Starts Today

Rebuilding your credit may seem overwhelming, but with the right guidance and the Best Credit Cards for Bad Credit, it becomes achievable. The secret is consistency and responsible usage. Even if you start with a low limit or deposit, think of this as your opportunity to prove creditworthiness.

You are not alone in this journey. Thousands of people have successfully rebuilt their credit using the exact method described in this guide. With patience and discipline, you can improve your financial standing and qualify for better rates and benefits in the future.

Today might feel like a struggle, but every smart decision you make using the Best Credit Cards for Bad Credit will bring you one step closer to financial freedom.