Plan Your Future with Our Free Savings Goal Calculator

Estimate how much you need to save each month to reach your financial goals — simple, accurate, and tailored to your currency.

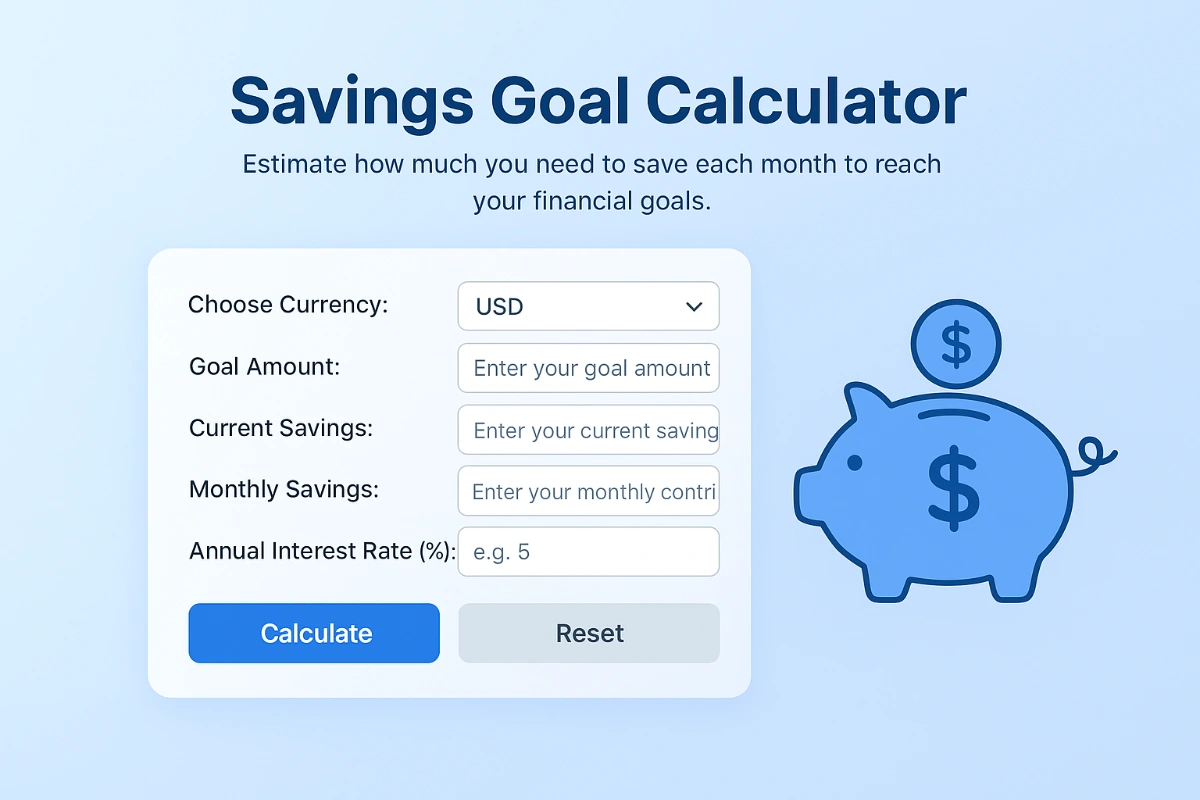

Savings Goal Calculator

Result

How to Use the Savings Goal Calculator

Our Savings Goal Calculator is designed to make planning your financial future simple and stress-free. Whether you’re saving for a new home, your dream vacation, or long-term wealth, this easy-to-use tool helps you estimate how much you need to save to reach your goal.

Here’s how it works:

- Select your currency — USD, EUR, GBP, AUD, AED, SAR, OMR, or KWD.

- Enter your goal amount — the total you want to achieve.

- Add your current savings and monthly contributions.

- Enter the annual interest rate and your target date.

- Click “Calculate” to see your projected savings instantly.

- Use “Reset” to start fresh anytime.

This tool acts as your personal financial goal planner, helping you stay focused, motivated, and in control of your future.

Savings Goal Calculator – Plan, Track, and Achieve Your Financial Dreams

Money goals often start with a dream — buying a home, taking a luxury vacation, sending your kids to college, or retiring comfortably. But dreams only come true when backed by a clear plan. That’s exactly where our Savings Goal Calculator comes in…

Savings Goal Calculator: Your Smart Partner for a Secure Financial Future

Everyone dreams of financial security, but very few take the right steps to plan it. A Savings Goal Calculator is one of the simplest and most effective tools that can help you turn your financial dreams into achievable goals. Whether you want to buy a new car, travel across Europe, save for your child’s education, or build a retirement fund, a calculator like this can help you plan smarter, not harder.

Why You Need a Savings Goal Calculator

Managing money can feel overwhelming, especially when you’re trying to balance daily expenses with long-term goals. This is where a goal-based savings calculator becomes your best companion. It gives you a clear roadmap — showing how much you need to save every month, how long it will take to reach your goal, and how interest can help your money grow over time.

For people living in countries like the United States, the United Kingdom, or Australia, where cost of living and financial responsibilities are high, having a reliable financial goal planner is essential. It provides structure and confidence in managing your finances and helps you stay committed to your saving journey.

How a Savings Calculator Online Works

The idea behind the calculator is simple yet powerful. You enter your goal amount, your current savings, the amount you can contribute monthly, and the interest rate you expect to earn. The savings calculator online instantly computes how long it will take to reach your target and how much you’ll accumulate by your chosen date.

For example, let’s say you want to save $50,000 for a home down payment. You already have $10,000 saved and can add $700 every month. With an annual interest rate of 3%, the calculator can estimate how long you’ll need to continue saving before you reach your target. This clarity helps you make informed financial decisions instead of guessing or stressing.

The Power of Compounding in Your Financial Journey

When using a savings goal planner, one of the most rewarding factors is compound interest. It’s the process of earning interest on your interest. Over time, compounding can dramatically increase your total savings — even if your monthly contributions remain the same. The calculator shows this growth visually, helping you appreciate how starting early makes a massive difference.

For instance, saving €400 a month at 4% annual interest may not sound significant at first. But after ten years, you’ll have saved more than €58,000, out of which almost €10,000 is just interest. This is the beauty of consistent saving and the power of compounding.

Tailored for Every Currency and Goal

One of the biggest advantages of a modern goal-based savings tool is its flexibility. You can use it in various currencies like USD, Euro, British Pound, Australian Dollar, AED, SAR, OMR, or Kuwaiti Dinar. This makes it ideal for people working abroad, managing global investments, or planning goals across multiple countries.

Whether you live in Dubai, London, or Sydney, you can easily switch your preferred currency and calculate with real-time accuracy. The calculator helps you plan based on your local income and lifestyle, ensuring your goals remain realistic and attainable.

Benefits of Using a Savings Goal Calculator Regularly

Financial planning isn’t something you do once and forget. It’s a continuous process that adapts to your income, lifestyle, and goals. By using a savings calculator online regularly, you can keep track of your progress and make small adjustments that lead to big rewards over time.

1. Stay on Track with Your Goals

It’s easy to lose sight of your financial objectives when life gets busy. The calculator helps you stay accountable by showing exactly how close you are to your target. If you’re behind schedule, it motivates you to save a little extra.

2. Understand the Impact of Interest Rates

Even a one-percent difference in interest rates can have a major effect on your final amount. The calculator lets you experiment with different rates to see how they impact your total savings. This insight helps you choose better savings accounts or investment plans.

3. Adjust for Lifestyle Changes

As your income grows or your expenses shift, you can easily update your inputs. Maybe you got a raise or reduced your monthly spending — the calculator will show how these changes improve your results.

Saving for Short-Term vs Long-Term Goals

Everyone has different priorities. Some goals are short-term, like buying a laptop or going on vacation, while others are long-term, like retirement or home ownership. The financial goal planner adapts perfectly to both.

Short-Term Goals

For short-term goals, your focus should be on consistency and safety. Choose low-risk options like high-yield savings accounts or fixed deposits. Use the calculator to figure out exactly how much you need to set aside monthly to reach your goal within a year or two.

Long-Term Goals

For long-term goals, compounding plays a bigger role. You can afford to take moderate risks and earn higher interest. The calculator will help you forecast how different saving amounts and interest rates impact your 5, 10, or even 20-year horizon.

Why Visualization Matters in Saving

Humans are visual creatures. When we can see our progress and projections, we become more motivated to achieve them. The savings goal calculator does exactly that. By showing you charts, time frames, and interest effects, it turns abstract numbers into meaningful goals. It’s like having a personal financial coach guiding you every step of the way.

Building Discipline Through Smart Tools

Discipline is the backbone of saving. Many people start with great enthusiasm but lose motivation over time. A goal-based savings tool keeps you focused by breaking large goals into manageable steps. Seeing measurable progress encourages you to stick with your plan. This sense of achievement builds financial confidence and helps develop lifelong saving habits.

Integrating the Calculator into Your Financial Routine

Using a savings goal calculator shouldn’t be a one-time activity. Instead, make it a part of your monthly financial check-up. Revisit your numbers after each payday or at the end of every quarter. Adjust your monthly contribution if your income increases or if you find a better interest rate. Over time, you’ll notice how this simple practice keeps your finances organized and your goals within reach.

Tips to Maximize Your Savings Strategy

1. Automate your savings so you don’t forget to deposit money each month.

2. Review your budget regularly and cut unnecessary expenses.

3. Reinvest the interest you earn instead of withdrawing it.

4. Set realistic goals — aiming too high can discourage you, while achievable targets build momentum.

5. Stay patient. Saving is a marathon, not a sprint.

The Psychology Behind Saving

Saving money isn’t just about numbers — it’s about mindset. Many people associate saving with sacrifice, but in truth, it’s about empowerment. Every dollar or euro you save today brings you closer to freedom tomorrow. Using tools like the savings calculator online transforms saving from a chore into a rewarding experience. You can watch your progress grow month after month, which creates a positive feedback loop.

Why First-World Users Love Smart Financial Tools

In developed economies, people often rely on digital tools for everything — from budgeting to investments. The financial goal planner fits seamlessly into this lifestyle. It’s fast, transparent, and available on any device. Whether you’re in New York, London, Sydney, or Dubai, you can calculate your savings goals in seconds. This accessibility helps busy professionals make data-driven financial decisions on the go.

Final Thoughts: Plan, Save, and Succeed

The journey toward financial freedom begins with awareness and action. A Savings Goal Calculator combines both. It gives you a clear vision of your targets, practical steps to achieve them, and the motivation to stay consistent. Whether your goal is small or large, local or global, this tool empowers you to take control of your future.

Remember, money grows with time, discipline, and planning. Start today. Use the calculator, set your goals, and watch your savings turn into your dreams.