If you are wondering how to build credit score and you feel confused by all those financial websites using complicated language you are not alone. I was also clueless when I first started understanding what a credit score is and how it affects my financial life. Today I will explain this topic to you exactly the way I would explain it to a close friend who has asked me for help over a cup of coffee. You do not need to be a banker or a finance expert. You only need to understand a few very simple facts and follow them consistently. That is the real secret of how to build credit score.

A credit score is basically a number that tells lenders how responsible you are when it comes to money. Think of it like your financial reputation. The higher the number the more trustworthy you appear to banks and credit companies. Once you know how to build credit score properly life becomes easier. You get loans approval faster lower interest rates higher credit card limits and even approval for renting a house. Every payment you make and every financial decision you take leaves a small footprint on your credit profile. Those footprints build your score over time.

If your score is low do not panic. Everyone starts somewhere. Some of the most financially successful people started with zero credit history. What matters is learning how to build credit score in a responsible way and applying those steps for a few months or years depending on how fast you want to grow it. Let us talk about this detail by detail and I will help you understand like we are just having a friendly chat.

First know that credit score grows when you show banks that you are responsible with debt. This means you pay your bills on time you do not borrow too much and you do not apply for too many loans or cards quickly. A credit score is built by time so make patience your friend.

The biggest mistake most people make when trying to figure out how to build credit score is assuming that taking multiple loans will help them build history faster. That is wrong. You need to treat credit like fire. A small controlled use is helpful but an uncontrolled approach may burn your financial stability.

Now let me guide you in a simple straightforward manner so you get a clear picture.

How to increase credit score quickly

I know that when people search how to increase credit score quickly they are often in urgent need. Maybe they want a new car loan or are planning to buy a house. Let me be honest. You can increase your score quickly but not overnight unless you already have a score that is not too bad. A rapid improvement usually requires these steps.

Start paying every single bill before the due date. Not just credit cards or loans but also utilities if reported rent if reported and mobile bills if linked to credit bureaus. Even one late payment can harm your score and delay your progress. If you keep making payments on time for at least three months you will see an improvement.

Credit utilization means how much of your available credit limit you are using. If your limit is one thousand dollars and you use nine hundred your utilization is very high and credit bureaus do not like that. If you want to understand how to increase credit score quickly keep your usage under thirty percent of your limit. Better if under twenty. This simple trick works like magic.

If you have errors in your credit report such as wrong late payment entries dispute them immediately. A corrected report can give a boost quickly.

Do not apply for multiple credit cards at the same time. Each application is counted as a hard inquiry which lowers your score short term.

If possible pay down some of your debts to reduce your utilization. Sometimes just paying extra one hundred or two hundred dollars can drop your utilization from high to moderate which helps you when trying to understand how to increase credit score quickly.

How to build credit score fast

Let me tell you how to build credit score fast using practical methods. Fast does not mean tomorrow but rather in a few months instead of years. Think of it as a speed training program for your financial profile.

Use a credit card but use it wisely. Spend small amounts each month and pay the full amount before the due date. This shows consistent responsible usage. Avoid cash advances because they can send wrong signals.

Become an authorized user on someone else’s credit card. If that person has good credit history and they add you to their card your score can benefit due to their positive track record. It is like a shortcut often used by parents to help their adult children learn how to build credit score fast.

Take a small credit builder loan from a bank. These loans are designed specifically for those with little or no credit history. You make fixed payments every month and the bank reports those payments to the credit bureaus which improves your score.

Use rent reporting services if available where your regular rent payments get added to your credit file. If you are consistent this helps in understanding how to build credit score fast.

The key is consistency. If you manage your finances correctly for six months you can see a visible improvement.

How to build credit score with credit card

When someone asks me how to build credit score with credit card I always smile because this is one of the most effective ways if done correctly. A credit card is not a free pass to spend without concern. Instead treat it as a tool to prove your financial responsibility.

Use your credit card for normal expenses that you can easily afford to pay back. For example groceries fuel subscription services or small shopping. Do not use it for luxuries you cannot pay off because that is where trouble begins.

Always pay the full balance not just the minimum due. When you pay only minimum banks earn interest from you and your credit utilization remains high. Paying full amount before due date shows outstanding responsibility.

Avoid late payments. Set reminders. Use auto pay if possible. Only one late payment can drop your credit score significantly.

Do not use too much of your credit limit. Credit bureaus want to see that you are not dependent on credit. Keep utilization low.

If you manage these basics and use your credit card every month carefully you are directly practicing how to build credit score with credit card.

Raise credit score 100 points overnight

Let us be completely honest about this part. I know many people search raise credit score 100 points overnight because it sounds exciting. The truth is there is no legal way to jump 100 points overnight unless there is a major correction or error removed from your report. If your report has a wrong entry like a late payment that is not true or a closed loan that is still shown as active and you get it corrected immediately then yes you can see a sharp increase even up to 100 points if you are lucky.

But normally raising your credit score by 100 points overnight is not practical. Banks do not update your reports daily and credit bureaus need time to reflect changes. The best you can do to move closer to this goal is paying down large outstanding amounts quickly especially if you are using too much of your credit limit. When utilization drops dramatically sometimes your score jumps significantly but again it depends on the next reporting cycle.

Another way some people see a quick improvement is by being added as an authorized user on someone with excellent credit. If that account has a long positive history and low credit utilization you might see a quick increase. But overnight is honestly rare.

So instead of trying to raise credit score 100 points overnight focus on moves that can raise it rapidly within one to three months by paying on time reducing utilization and clearing small debts.

How to build credit score at 18

If you are 18 and asking how to build credit score at 18 I congratulate you. Starting this early is one of the smartest financial decisions you can make. Most people wait until they need a car loan or a house loan and then wonder why banks are not helping them. If you are beginning at 18 you are starting at the perfect stage.

Start by opening a secured credit card or a student credit card if available. A secured credit card requires you to deposit an amount usually the same as your credit limit. Use it like a normal card but pay bills always on time. This slowly builds your credit score.

Ask a parent or someone you trust if they are willing to add you as an authorized user to their card if they have a good payment history. This can give you a strong base.

Do not spend money you do not have. Just use the card for small expenses like mobile recharge or online subscription. Then pay it off entirely within the month.

Do not apply for multiple cards quickly. One is enough at this stage. Be patient and consistent. You will have excellent credit by the time you are in your early twenties.

That is how to build credit score at 18 and set yourself up for financial success.

How to build credit score from 0

Many people panic when they see that their credit score is zero and ask me how to build credit score from 0. Do not worry. It is very normal to start from zero. It simply means you have no credit history yet.

First open a secured credit card or a credit builder loan. These are designed for people with no credit. Use them responsibly and make all payments on time. That is enough to begin the process.

Use your card regularly for small purchases and clear the balance fully every month.

Avoid overdrafts and avoid borrowing from loan apps that do not report payments to major bureaus.

Pay all bills including utilities and internet on time. Some providers now allow customers to include those bills in credit history through third party reporting services.

Check your credit report every few months. Look for errors and correct them early.

With active usage and responsible payments you can build your score from zero to a decent level within six months to a year. That is how to build credit score from 0 step by step.

The psychology behind credit score growth

When you learn how to build credit score you are actually learning how to behave responsibly with money. Banks want to lend money to people who use it and return it on time. Think of it like this. If a friend keeps asking you for money and always returns it late would you feel safe lending again When we pay bills late credit bureaus record it and lenders become cautious. If we are consistent lenders become generous.

This is why the best strategy is long term thinking. Instead of rushing to find shortcuts focus on building a reputation of reliability.

Common mistakes while trying to build credit score

If you are exploring how to build credit score avoid making big mistakes. One common mistake is closing old accounts. Older accounts help build credit history. When you close them you reduce your history length which can lower your score.

Another mistake is applying for multiple credit cards or loans in a short time. Each time lenders check your report it leaves a mark known as hard inquiry. Too many inquiries in a short time are seen as financial stress.

Do not ignore small bills. Even a missed mobile payment if reported can damage your score.

Never use more than seventy percent of your credit limit. It gives the impression that you depend too much on credit.

The real secret of how to build credit score

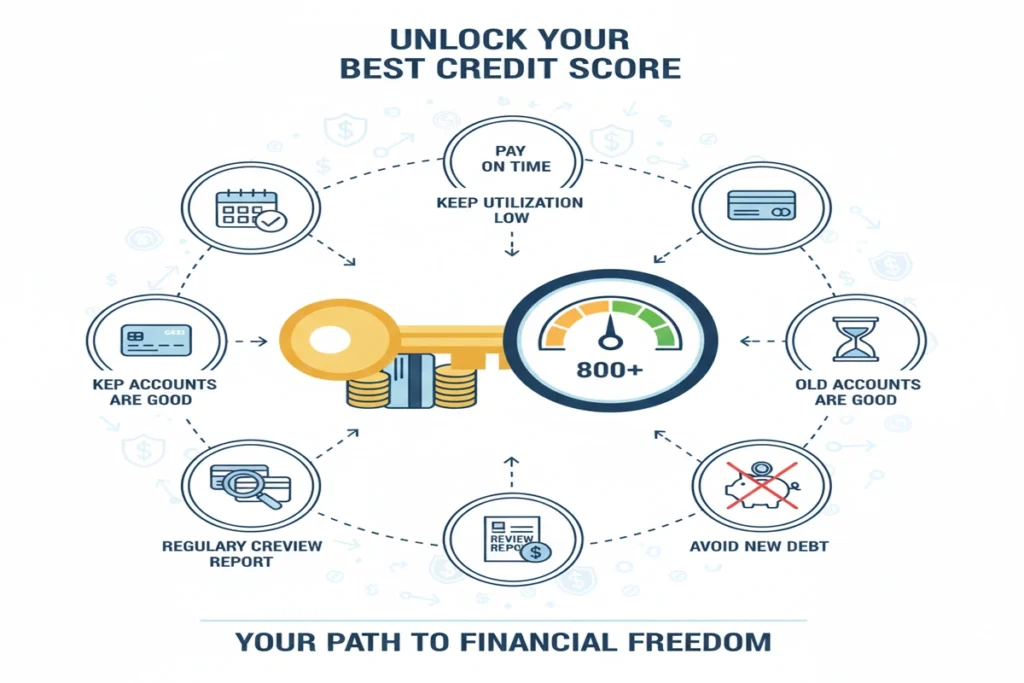

If you want the quickest summary of how to build credit score here it is. Use credit in small portions. Pay on time always. Keep utilization under thirty percent. Do not apply for multiple credit products unnecessarily. Let time help you build history.

Why building credit score matters

When your credit score is high you get best interest rates. You can negotiate better loan terms. Visa approvals and rental agreements become easier. Some employers even check credit reports before hiring for finance related positions. Insurance providers often adjust premiums based on credit score.

Understanding how to build credit score means investing in your future comfort and security.

Frequently asked questions

What if I already have a bad credit score Start over by paying bills on time and reducing your utilization. It may take longer but it is possible.

Is closing a credit card good No. Keep it open unless it has a heavy annual fee.

Does checking my score reduce it No. Only hard inquiries reduce score. Checking your score personally is a soft inquiry.

Final thoughts

Learning how to build credit score is not about tricks. It is about consistency smart usage and time. Imagine this like maintaining a healthy lifestyle. You cannot lose weight overnight but if you exercise daily and eat balanced food you will see amazing results in a few months.

The beauty of financial discipline is that it pays you back with comfort security and peace of mind. So start today. Pay your bills on time keep credit usage low and do not panic if you do not see results instantly. Improvement slowly appears and once momentum starts it gets easier.

If you follow the steps we discussed above I promise that within six to twelve months you will feel proud of how much your score has improved. That is how to build credit score just like I would advise my best friend.

FAQ Section (For Article Content)

1. How long does it take to build credit score?

It usually takes between three to six months of consistent on-time payments and responsible usage to see a noticeable improvement. If you already have some credit history, progress can be faster. For those starting from zero, it may take up to a year to build a strong score.

2. What is the fastest way to increase credit score?

The fastest way is to reduce your credit utilization to below 30 percent, pay all bills on time, clear any small pending dues and avoid applying for new credit. If you correct any error on your credit report, your score may improve faster.

3. Can I build credit without a credit card?

Yes, you can use a credit builder loan, report rent payments through a service, or use utilities and telecom bills if your service provider reports to credit bureaus. However, using a credit card responsibly is still the most effective method.

4. Can I raise my credit score 100 points overnight?

In most cases no, but if your report contains incorrect information like a false late payment or wrong account status and it is corrected immediately, then a rapid increase is possible. Generally, real score growth takes time and consistency.

5. What happens if I pay only minimum amount on my credit card?

Your credit score will not directly drop if you pay minimum but your credit utilization remains high and you will be charged interest. This may negatively affect your score over time.

6. Is closing a credit card good for my credit score?

Closing a credit card may reduce your available credit limit and shorten the age of your accounts, which can lower your score. Only close if it has high fees and no benefit.

7. How to build credit score from zero at 18 years old?

Start with a secured or student credit card, spend very small amounts and pay back fully. Have a parent add you as an authorized user if possible. Consistency for six months to a year will build a solid foundation.

8. How can I check my credit score for free?

You can check through official credit bureau websites, specialized finance apps and some banks which provide free monthly credit score tracking. Make sure it is a soft enquiry.

How Fast Can I Improve My Credit Score Credit Card Payoff Calculator

Leave a Reply