Building a home from scratch is exciting. But financing it can feel overwhelming—especially when you hear terms like construction draws, approvals, and permanent financing.

Quick Summary: VA Construction Loans

A VA construction loan allows eligible U.S. veterans and service members to finance the construction of a new home and convert it into a permanent VA mortgage. These loans typically require no down payment, do not include private mortgage insurance, and offer competitive interest rates. Funds are released in stages during construction, and the loan becomes a standard VA home loan after completion.

If you’re an eligible U.S. veteran or active-duty service member, a VA construction loan can make the process far simpler than most people expect. It combines construction financing and a long-term mortgage into one VA-backed loan, often with lower upfront costs.

Here’s everything you need to know, explained clearly and honestly.

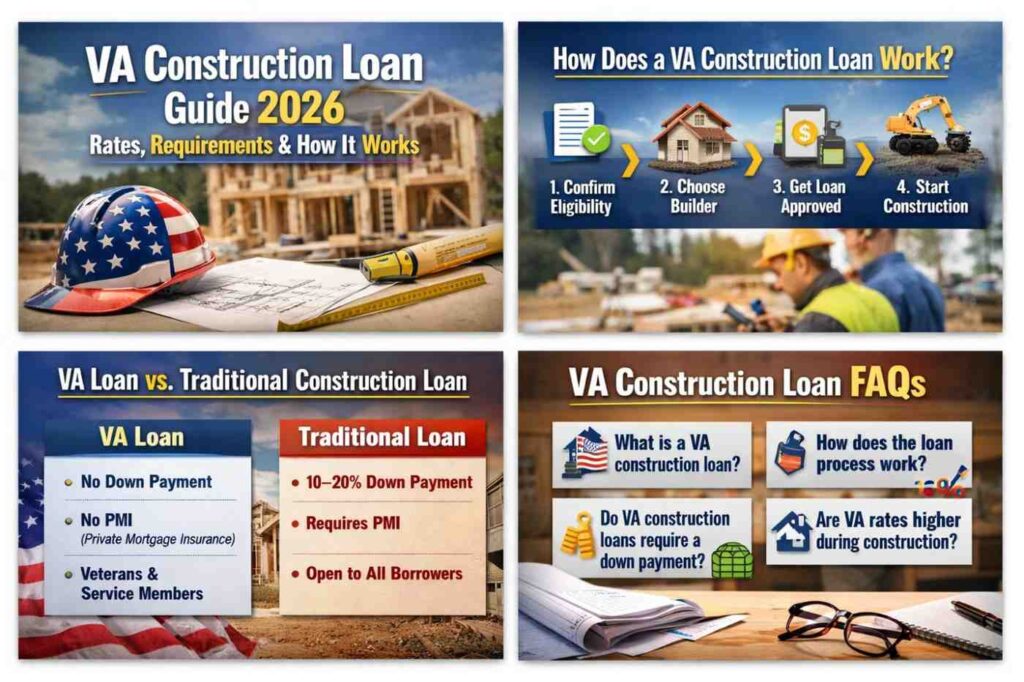

VA Construction Loan vs Traditional Construction Loan

- Down payment: VA loans often require none; traditional loans usually require 10–20%

- Mortgage insurance: VA loans have no PMI; traditional loans often require it

- Eligibility: VA loans are limited to veterans and service members

Quick Summary: VA Construction Loans

A VA construction loan allows eligible U.S. veterans and service members to finance the construction of a new home and convert it into a permanent VA mortgage. These loans typically require no down payment, do not include private mortgage insurance, and release funds in stages during construction. After the home is completed and approved, the loan becomes a standard VA home loan.

What Is a VA Construction Loan?

A VA construction loan is a mortgage backed by the U.S. Department of Veterans Affairs that helps qualified borrowers build a primary residence.

Instead of taking out a short-term construction loan and then refinancing later, this loan combines:

- Construction costs

- Permanent VA mortgage

into one single loan.

This structure reduces paperwork, closing costs, and financial stress.

How Does a VA Construction Loan Work?

A VA construction loan works by funding your home build in stages, not all at once.

Here’s the simple process:

- You confirm VA eligibility with a Certificate of Eligibility (COE)

- You choose a VA-approved builder

- A VA construction loan lender approves your plans and budget

- Funds are released in phases as construction progresses

- After completion, the loan converts into a permanent VA mortgage

You don’t need to refinance or apply again after construction ends.

Why this matters: Traditional construction loans often require multiple closings and higher risk. VA loans reduce that burden.

VA Construction Loan Rates in 2026 Explained

VA construction loan rates in 2026 are expected to remain competitive compared to conventional construction loans.

What borrowers usually see:

- Slightly higher rates during construction

- Conversion to standard VA mortgage rates after completion

- No private mortgage insurance (PMI), which lowers monthly costs

Rates vary by lender, credit profile, and market conditions, so comparing offers is important.

VA Construction Loan Requirements You Must Meet

VA construction loans have stricter requirements than regular VA home loans, but they’re still more flexible than most construction financing.

Common requirements include:

- VA Certificate of Eligibility (COE)

- VA-approved builder

- Credit score typically around 620 or higher

- Stable income and manageable debt-to-income ratio

- The home must be your primary residence

The finished property must also meet VA minimum property standards.

VA Construction Loan Lenders: What to Know

Not every VA lender offers construction loans. This is one of the biggest challenges borrowers face.

When choosing a VA construction loan lender, look for:

- Experience with VA construction loans

- Clear draw schedules and inspections

- Transparent fees and timelines

Many borrowers work with specialized lenders or credit unions familiar with VA construction financing.

Using a VA Construction Loan Calculator

A VA construction loan calculator helps you estimate:

- Monthly mortgage payments

- Total loan amount

- Interest during construction

- Long-term affordability

These tools don’t replace lender quotes, but they’re very useful for planning your budget before applying.

VA Construction Loans vs Traditional Construction Loans

Here’s a quick comparison:

- Down payment:

VA loans often require none; traditional loans usually require 10–20% - Mortgage insurance:

VA loans have no PMI; traditional loans often include it - Eligibility:

VA loans are only for eligible veterans and service members

This difference is why VA construction loans are often considered lower risk for qualified borrowers.

Important Note for UK Readers

VA construction loans are available only in the United States through the U.S. Department of Veterans Affairs.

The UK does not offer VA loans. However, UK armed forces members often explore alternatives such as self-build mortgages or Armed Forces Help to Buy schemes. These are separate programs with different rules.

Frequently Asked Questions

What is a VA construction loan?

A VA construction loan is a VA-backed mortgage that finances building a home and converts into a permanent VA loan after construction is completed.

How does a VA construction loan work?

The loan releases funds in stages during construction and automatically becomes a standard VA mortgage once the home passes final inspection.

Are VA construction loan rates higher?

Rates may be slightly higher during construction but usually convert to competitive VA mortgage rates afterward.

Do VA construction loans require a down payment?

Most VA construction loans allow eligible borrowers to build with no down payment, though some lenders may ask for a small upfront contribution.

Are VA construction loans hard to get?

They are more complex than regular VA loans because fewer lenders offer them, but they are still easier than many traditional construction loans.

How to Get a VA Construction Loan (Simple Steps)

- Confirm VA eligibility

- Select a VA-approved builder

- Choose an experienced VA construction loan lender

- Submit construction plans and budget

- Begin construction with staged funding

- Convert to a permanent VA mortgage

Final Thoughts

A VA construction loan isn’t the right choice for everyone. But for eligible veterans and service members who want to build a primary residence, it can be one of the most cost-effective and stable ways to do it in 2026.

If you qualify, it’s worth exploring carefully—with the right lender and a realistic construction plan.

Read also: Credit Card vs Debit Card: Which Is Safer for Online & Travel Payments?

How Credit Card Interest (APR) Really Works – Simple Explanation With Real Examples

Investment Guide for GCC Professionals: How to Grow Your Money Smartly

Leave a Reply