Credit Card vs Debit Card: Most people lose money online or while traveling—not because of scams, but because they used the wrong card.

A single compromised debit card can freeze your rent money. A poorly chosen payment method abroad can lock up thousands in hotel deposits. And many travelers only realize the difference after the damage is done.

So which is actually safer—credit cards or debit cards—for online shopping and international travel?

This expert-backed guide compares real-world risk, fraud recovery speed, chargeback power, and consumer protection laws across the US, Canada, and Europe, so you can protect your money before something goes wrong—not after.

When paying online or abroad, one wrong card choice can cost you thousands—and not just in money, but in time, stress, and lost peace of mind.

Many people assume debit cards are safer because they use “your own money.” Others swear by credit cards for every transaction. The truth is more nuanced—and far more important—especially as online fraud, data breaches, and travel scams continue to rise across the US, Canada, and Europe.

This guide breaks down credit cards vs debit cards in real-world situations:

✔ Online shopping

✔ International travel

✔ Fraud protection

✔ Chargebacks

✔ Data breaches

✔ Emergency scenarios

By the end, you’ll know exactly which card is safer, when, and why—and how to use both without putting your finances at risk.

Quick Answer (Featured Snippet Optimized)

Credit cards are generally safer than debit cards for online and travel payments because they offer stronger fraud protection, easier chargebacks, limited liability, and do not expose your bank balance directly.

Debit cards still have their place—but using them incorrectly can leave you financially vulnerable.

Understanding the Core Difference

What Is a Credit Card?

A credit card lets you borrow money from the card issuer up to a limit. You repay later, often with interest if you don’t pay in full.

Key feature:

- Fraud affects the issuer’s money first, not yours

What Is a Debit Card?

A debit card pulls money directly from your bank account.

Key feature:

- Fraud affects your actual cash balance immediately

This single difference changes everything about safety.

Online Payment Safety: Credit Card vs Debit Card

Why Online Payments Are Risky

Online transactions expose your card details to:

- Data breaches

- Phishing attacks

- Fake websites

- Malware

- Merchant security failures

Once compromised, your card number can be used globally within minutes.

Credit Card Safety for Online Shopping

Advantages:

- Strong fraud detection systems

- Zero or limited liability policies

- Easy chargebacks for unauthorized transactions

- Disputes handled by issuer, not your bank

If fraud occurs:

- Your bank account remains untouched

- You can dispute without losing access to funds

📌 In the US, the Fair Credit Billing Act caps liability at $50 (often $0).

📌 In the EU and UK, PSD2 and card network rules offer similar protections.

Debit Card Safety for Online Shopping

Risks:

- Money is withdrawn instantly

- Rent, bills, or EMIs may bounce

- Fraud recovery can take weeks

- Temporary cash shortages

Even if banks reimburse you, the delay itself can cause damage.

Winner for Online Payments

✅ Credit Card (by a wide margin)

Travel Payments: Credit Card vs Debit Card

Why Travel Increases Risk

Travel exposes your card to:

- Foreign merchants

- Unfamiliar ATMs

- Skimming devices

- Currency conversion traps

- Hotel and car rental holds

Using Credit Cards While Traveling

Major Benefits:

- Accepted worldwide

- Better exchange rates

- Built-in travel insurance

- No direct access to your bank account

- Emergency replacement services

Hotels and car rentals often require credit cards for security deposits.

Using Debit Cards While Traveling

Common Problems:

- Large security holds block your funds

- ATM skimming risks

- Limited fraud support abroad

- Foreign ATM fees

- Currency conversion markups

If your debit card is compromised overseas:

- You may lose access to cash

- Bank support may be slower

- Reimbursement timelines vary

Winner for Travel Payments

✅ Credit Card for payments

⚠️ Debit card only for ATM withdrawals

Fraud Protection: Side-by-Side Comparison

| Feature | Credit Card | Debit Card |

|---|---|---|

| Fraud liability | Limited / $0 | Limited but slower |

| Access to funds | Unaffected | Funds frozen |

| Dispute speed | Faster | Slower |

| Chargeback rights | Strong | Weaker |

| Stress level | Lower | Higher |

Chargebacks & Disputes: Why They Matter

A chargeback lets you reverse a transaction for:

- Fraud

- Undelivered goods

- Defective products

- Merchant disputes

Credit Cards

- Designed for disputes

- Strong consumer laws

- Issuer fights merchant for you

Debit Cards

- Technically possible

- More paperwork

- Longer resolution

- Depends heavily on bank policies

📌 Chargebacks are one of the biggest safety advantages of credit cards.

What Happens During a Data Breach?

When a merchant is hacked:

- Millions of card numbers leak

- Fraudsters test small charges

- Then escalate

With a Credit Card

- Fraud detected

- Card frozen

- Charges reversed

- New card issued

With a Debit Card

- Bank account drained

- Payments fail

- Stress escalates

- Recovery takes time

Psychological Safety Matters Too

Financial safety isn’t just technical—it’s emotional.

Credit cards provide:

- Time to react

- Buffer against emergencies

- Reduced panic

Debit card fraud often creates:

- Immediate anxiety

- Cash shortages

- Missed obligations

Are Debit Cards Ever the Better Choice?

Yes—when used strategically.

Best Use Cases for Debit Cards

- ATM cash withdrawals

- Local in-person purchases

- Trusted domestic merchants

- Budget control for some users

But:

❌ Not ideal for large purchases

❌ Not ideal for online subscriptions

❌ Not ideal for international travel payments

Hidden Travel Traps Most People Miss

1. Hotel & Rental Deposits

Debit cards can lock up hundreds or thousands temporarily.

2. Dynamic Currency Conversion

Merchants may charge in your home currency at poor rates—more common with debit cards.

3. Offline Transactions

Some travel charges process later, complicating debit account balances.

Security Tips for Both Cards

Use These Best Practices

- Enable transaction alerts

- Use virtual card numbers online

- Avoid public Wi-Fi payments

- Lock cards when not in use

- Monitor statements weekly

Which Card Is Safer by Scenario? (Quick Guide)

| Scenario | Safer Card |

|---|---|

| Online shopping | Credit Card |

| International travel | Credit Card |

| Hotel bookings | Credit Card |

| Car rentals | Credit Card |

| ATM withdrawals | Debit Card |

| Everyday local spending | Either |

US, Canada & Europe: Regional Considerations

United States

- Strong credit card consumer laws

- Widespread chargeback rights

- Credit cards highly recommended

Canada

- Slightly slower debit dispute timelines

- Credit cards offer better travel benefits

Europe (UK/EU)

- Strong PSD2 protections

- Debit cards common—but credit cards still safer for disputes

Final Verdict: Which Is Safer?

Short Answer

Credit cards are safer than debit cards for online and travel payments.

Long Answer

Use credit cards for spending, debit cards for cash access, and never expose your primary bank account unnecessarily.

The smartest consumers don’t choose one—they use both intentionally.

Key Takeaway

Debit cards spend money.

Credit cards protect money.

Choose accordingly.

Frequently Asked Questions (FAQ)

Q1: Which is safer for online shopping: credit card or debit card?

A: Credit cards are safer for online shopping because they offer stronger fraud protection, easier chargebacks, and do not directly expose your bank account.

Q2: Is it safe to use a debit card while traveling internationally?

A: Debit cards are best used for ATM withdrawals while traveling. Using them for payments can risk freezing your bank funds if fraud occurs.

Q3: Why do hotels and car rental companies prefer credit cards?

A: Hotels and car rentals prefer credit cards because security deposits can be placed without blocking your personal bank funds.

Q4: Can debit card fraud be reversed?

A: Debit card fraud can often be reversed, but recovery may take longer, and your funds may remain unavailable during investigation.

Q5: Should I carry both credit and debit cards when traveling?

A: Yes. Use a credit card for payments and deposits, while a debit card is best reserved for ATM cash withdrawals.

How to Choose the Safest Card for Online & Travel Payments

- Identify the payment type – Determine whether your payment is online, international, or requires a security deposit.

- Use a credit card for high-risk payments – For online shopping, hotels, flights, and car rentals, a credit card protects your money better.

- Limit debit card usage – Use debit cards mainly for trusted ATM withdrawals to reduce exposure to fraud.

- Enable security alerts – Turn on transaction alerts and international usage notifications to catch suspicious activity quickly.

- Monitor transactions regularly – Check statements frequently to detect unauthorized charges early.

About the Author

SavvyMoneyWise Editorial Team specializes in consumer finance education, with a focus on credit cards, fraud protection, digital payments, and travel money safety.

Our content is developed through:

- Analysis of banking laws and consumer protection policies

- Credit card issuer terms & card network rules

- Real-world fraud recovery case studies

We aim to explain financial topics clearly, accurately, and without bias, helping readers protect their money in both online transactions and international travel.

🛡️ Accuracy and transparency are our priorities.

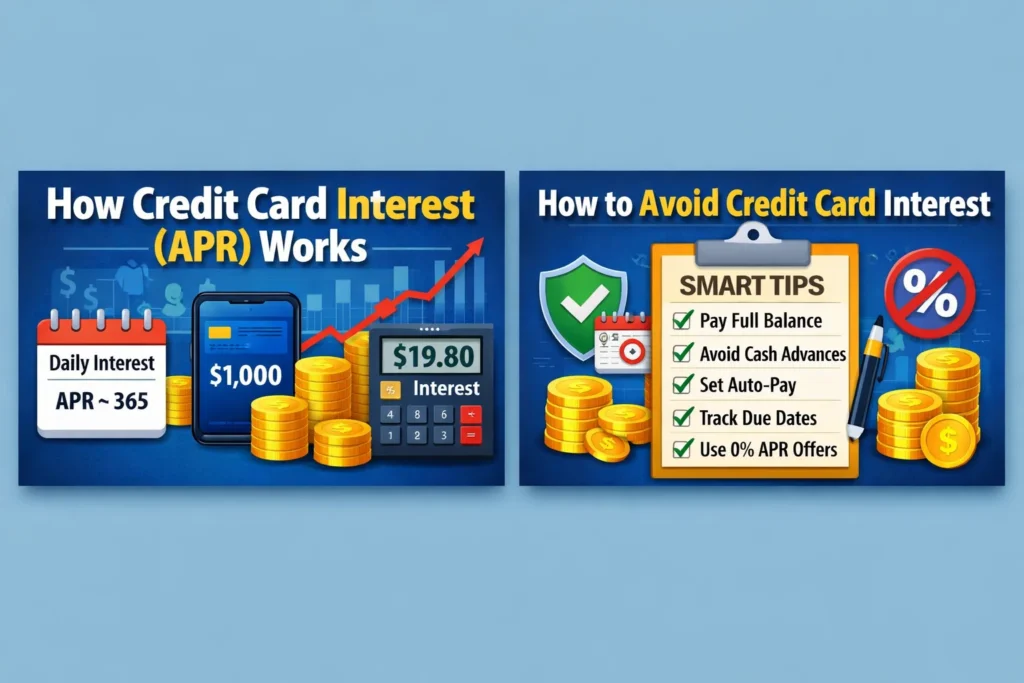

Read also: How Credit Card Interest (APR) Really Works – Simple Explanation With Real Examples

Investment Guide for GCC Professionals: How to Grow Your Money Smartly

Leave a Reply