Financial Literacy 101: Everything You Should Know Before Investing

Financial Literacy 101: If you have ever looked at your paycheck, your expenses, and your dreams and thought, “How do I make this money work for me?” — you’re already on the right path. That question is where financial literacy begins.

Financial Literacy 101, Before you start buying stocks or diving into cryptocurrencies, you need to understand the foundation of money management. Investing is not about luck. It’s about knowledge, preparation, and mindset. Think of financial literacy as learning to swim before diving into deep waters.

This guide is your complete roadmap to understanding the essentials of personal finance and investing — designed especially for readers in the USA, Canada, and the UK who want to make smarter financial decisions and build long-term wealth.

1. What Is Financial Literacy and Why It Matters

Financial Literacy 101: Financial literacy means having the ability to understand and manage your money effectively. It’s knowing how to budget, save, invest, and make decisions that align with your goals.

Unfortunately, most people enter adulthood without this skill. They learn through mistakes — maxed-out credit cards, missed payments, or impulsive investments. But financial literacy changes that. It gives you control.

In simple terms, being financially literate allows you to:

- Understand how money flows in and out of your life.

- Make informed financial decisions.

- Protect yourself from bad debt and scams.

- Grow your wealth systematically.

In the USA, Canada, and the UK, financial literacy rates are improving, but there’s still a gap between knowing how to earn money and knowing how to manage it. This article aims to bridge that gap.

2. Understanding the Basics: Income, Expenses, and Cash Flow

Before you can invest, you need to know what’s coming in and what’s going out. Your cash flow is the backbone of your financial health.

Start by writing down your income — your salary, freelance work, side hustles, or passive earnings. Then, list all your monthly expenses — rent or mortgage, groceries, utilities, subscriptions, and personal spending.

Once you have these numbers, calculate your net savings:

Income minus Expenses = Savings

If your savings are low or inconsistent, that’s where you start improving. The goal is not to cut every joy out of your life but to give your money a purpose. A clear, intentional budget is your first step toward investing wisely.

3. Budgeting: The Foundation of Every Financial Plan

Budgeting often sounds restrictive, but it’s actually the opposite. A good budget gives you freedom. It tells your money where to go instead of wondering where it went.

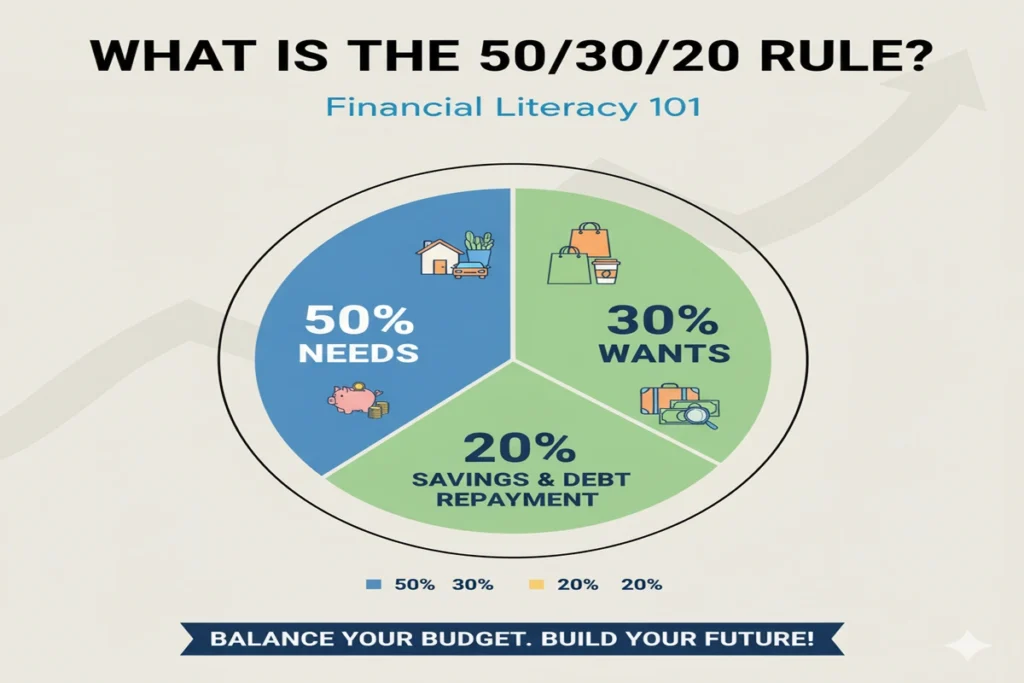

The 50-30-20 rule is a simple framework many people in North America and the UK use:

- 50% for needs

- 30% for wants

- 20% for savings and investments

You can adjust this based on your lifestyle. The key is consistency. Even if you start small, your discipline will grow faster than your income ever could.

Apps like Mint (USA), YNAB (Canada), or Money Dashboard (UK) can help track your spending automatically. But remember, the app doesn’t build wealth — your behavior does.

4. The Importance of an Emergency Fund

Before investing, build an emergency fund. This is your financial safety net — money kept aside for unexpected events like job loss, medical expenses, or urgent repairs.

Ideally, save at least three to six months of your living expenses in a separate high-yield savings account.

This step prevents panic selling or unnecessary debt when emergencies strike. Every financially stable investor has one thing in common — they protect themselves before chasing growth.

5. Understanding Debt: Good vs Bad Debt

Not all debt is harmful. Debt becomes dangerous only when it controls you.

Good debt helps you build value — like a student loan for education or a mortgage for a home that appreciates in value.

Bad debt drains your finances — like high-interest credit cards or payday loans.

If you’re carrying bad debt, focus on paying it down before investing heavily. Start with the debt snowball method (paying off the smallest debts first for motivation) or the avalanche method (tackling high-interest debts first).

Being debt-free gives you the psychological and financial space to grow your investments confidently.

6. The Concept of Compound Interest

Albert Einstein once called compound interest the eighth wonder of the world. He wasn’t exaggerating.

Compound interest means you earn interest not only on your original money but also on the interest it earns over time.

For example, if you invest $5,000 at an annual return of 8%, in 20 years that grows to more than $23,000 without you adding a single extra dollar.

This is why time in the market is far more powerful than timing the market. The earlier you start, the better your results — no matter where you live, whether in the USA, Canada, or the UK.

7. Setting Financial Goals

Goals turn your money into a mission. Without them, you’ll drift.

Start by defining your short-term, medium-term, and long-term financial goals:

- Short-term: Pay off credit card debt, build an emergency fund, save for a trip.

- Medium-term: Buy a car, invest in education, save for a down payment.

- Long-term: Achieve financial independence, buy a home, or retire comfortably.

Each goal needs a timeline and a number. When you know what you’re working toward, your motivation to save and invest increases naturally.

8. Investment Basics: Where to Start

Investing is how you make your money work for you. It’s the process of putting money into assets that can grow over time.

Here are some of the most common types of investments:

- Stocks: Ownership in a company. They offer high potential returns but also high risk.

- Bonds: Loans to governments or corporations. Lower risk but lower returns.

- Mutual Funds: Pools of money managed by professionals who invest in diversified portfolios.

- ETFs (Exchange-Traded Funds): Similar to mutual funds but traded like stocks, often with lower fees.

- Real Estate: Physical property that can appreciate in value and generate rental income.

If you’re a beginner, start with index funds or ETFs — they are simple, diversified, and low cost.

9. Risk and Return: The Heart of Investing

Every investment involves risk. The key is understanding your risk tolerance — how much uncertainty you can handle emotionally and financially.

Higher risk often brings higher potential returns, but not always. That’s why diversification is essential. Don’t put all your eggs in one basket. Spread your investments across different asset types and industries.

When markets fluctuate, remember: volatility is normal. It’s part of the game. Successful investors learn to stay calm during downturns and consistent during upturns.

10. The Power of Diversification

Diversification means spreading your investments so one bad decision doesn’t destroy your portfolio.

You can diversify by:

- Investing in different asset classes (stocks, bonds, real estate)

- Choosing different sectors (technology, healthcare, energy)

- Buying global investments (USA, Canada, UK, Europe, Asia)

It’s your insurance against uncertainty. You won’t hit home runs every time, but you’ll avoid financial disaster — and that’s how real wealth is built.

11. Taxes and Investments

In the USA, Canada, and the UK, taxes play a big role in your investment outcomes.

- In the USA, consider IRAs and 401(k)s for retirement savings — they offer tax advantages.

- In Canada, use RRSPs and TFSAs for similar benefits.

- In the UK, ISAs (Individual Savings Accounts) allow tax-free growth up to a certain limit.

Understanding tax-efficient investing helps you keep more of what you earn — and that’s just as important as making good returns.

12. The Psychology of Money

Financial success is not just about numbers — it’s about behavior.

Your mindset determines your outcomes more than market movements do. Many people know what to do but fail to act because of fear, greed, or impatience.

To stay financially grounded:

- Avoid emotional investing

- Be patient with your goals

- Don’t compare your journey with others

The most powerful financial tool you own is your mindset.

13. Building an Investment Plan

Your investment plan should reflect your goals, risk tolerance, and timeline. Here’s a simple structure:

- Set your target goals

- Determine how much to invest monthly

- Choose your asset mix (stocks, bonds, ETFs)

- Rebalance once or twice a year

- Stay consistent

Investing is not a one-time decision — it’s a lifelong habit.

14. Staying Educated and Avoiding Scams

The more you learn, the better your results. Follow credible sources, read financial news, and study successful investors.

At the same time, stay alert. Scams often target beginners with promises of guaranteed returns. If it sounds too good to be true, it probably is.

Real investing takes time, patience, and discipline.

15. The Journey to Financial Independence

Financial literacy is not just about numbers — it’s about freedom. The freedom to make choices without fear, to retire early if you wish, and to live life on your own terms.

When you control your money, you control your future.

Start small. Stay consistent. Keep learning. That’s the real secret to financial independence.

Final Thoughts

Becoming financially literate is the most valuable investment you’ll ever make. Before you invest in any stock, fund, or business, invest in your own knowledge.

Whether you’re in the USA, Canada, or the UK, the principles remain the same — understand, plan, and take informed action.

Money doesn’t grow overnight. But with patience and smart decisions, your financial garden will flourish.

Smart Investment Calculators

Financial Literacy for Students: Financial Literacy 101

Money is something everyone uses, but very few truly understand how it works. For students, learning financial literacy is one of the most valuable skills that can shape their entire future. Whether you are in high school or college, knowing how to manage your money can save you from stress, debt, and poor financial decisions later in life. Financial literacy is not about being rich; it is about being smart with what you have. Let us explore the basics in a simple and practical way, just like I would explain it to a friend.

What Is Financial Literacy

Financial literacy means having the knowledge and skills to make informed decisions about money. It involves understanding how to earn, spend, save, borrow, and invest. Many people think money management is complicated, but it really comes down to a few simple habits and a little bit of awareness. The earlier you start learning these things, the better control you will have over your financial life.

For students, financial literacy helps in daily life decisions such as managing pocket money, saving for goals, and avoiding unnecessary debt. When you understand how money works, you make choices that move you closer to financial freedom instead of falling into financial traps.

Why Financial Literacy Matters for Students

As a student, you might not be earning much yet, but the habits you form now will guide your entire future. Think about how many adults struggle with credit card debt or live paycheck to paycheck. Most of them never learned financial literacy when they were younger. Learning about money now gives you a head start.

Financial literacy helps you understand how to:

- Create and follow a budget

- Manage student loans or scholarships

- Use credit responsibly

- Build savings for emergencies

- Plan for future goals such as higher education or travel

When you are financially literate, you feel more confident and independent. You stop depending on others for every financial decision and start building a foundation for a secure future.

Learning How to Budget

Budgeting is the foundation of financial literacy. It simply means planning where your money will go before you spend it. Many students receive allowances or part-time income and spend it quickly without thinking. A simple budget helps you understand your spending patterns and gives you control.

Start by writing down your monthly income and your fixed expenses such as food, transport, and books. Then set aside a small portion for savings and personal spending. For example, if you receive $200 per month, you might decide to save $40, spend $100 on essentials, and keep $60 for leisure.

Budgeting is not about restriction; it is about direction. It helps you see clearly where your money goes and how you can improve your choices. There are also free budgeting apps that can help you track your spending more easily.

Understanding Savings and Emergency Funds

Saving money might sound boring, but it is one of the smartest things you can ever do. Even if you save a small amount regularly, it builds a habit that can change your life. Savings are not just for future goals; they also protect you from unexpected problems.

Imagine your phone breaks or you need an urgent bus ticket home. Having a small emergency fund means you can handle the situation without borrowing money or panicking. Experts suggest having at least three months’ worth of expenses as an emergency fund, but as a student, even saving a few hundred dollars can make a big difference.

One effective rule is the 50-30-20 rule: use 50 percent of your income for needs, 30 percent for wants, and 20 percent for savings. You can adjust it to your situation, but always make saving a priority.

Managing Debt Wisely

Debt can be helpful if used responsibly, but it can also become a trap. Student loans, credit cards, and even small borrowings from friends can add up quickly. The key is to understand what you are getting into before you borrow.

If you have a student loan, know the total amount you owe and the interest rate. Make sure you understand how much you will need to pay after graduation. Avoid using credit cards for unnecessary spending; they can be useful for emergencies but dangerous if you are not disciplined.

Good debt, such as an education loan that helps you get a better job, can be beneficial. Bad debt, like spending on luxury items or entertainment that you cannot afford, can cause long-term stress.

The Power of Investing Early

Most students think investing is only for rich people or those who already have a career. The truth is, the earlier you start investing, the more powerful it becomes due to something called compound interest. Compound interest means your money earns returns, and those returns earn more returns over time.

Even small investments can grow into a large amount if you start early and stay consistent. You can begin with simple options such as mutual funds, index funds, or savings accounts that offer interest. Before investing, always do your research or seek guidance from someone knowledgeable.

Understanding Credit and Credit Scores

Your credit score is like a financial report card. It shows how responsible you are with borrowing and repaying money. A good credit score can help you get loans easily, rent an apartment, or even qualify for better job opportunities in some cases.

To build a good credit score, always pay your bills on time, avoid maxing out your credit card, and never ignore loan payments. Having a small credit card and using it responsibly can actually help you build a good credit history.

Smart Spending Habits

Being financially literate does not mean you cannot enjoy your money. It means spending wisely. Before buying something, ask yourself if you really need it or if it is just an impulse. Small daily expenses such as coffee or fast food can add up to a big amount over time.

Look for student discounts, compare prices, and make use of free resources such as online courses or library materials. Smart spending is about making thoughtful decisions, not cutting out fun entirely.

Setting Financial Goals

Having goals gives your financial journey direction. Whether you want to save for a laptop, a trip, or your first car, writing down clear goals helps you stay focused. Break your goals into short-term and long-term targets.

Short-term goals can be saving $100 in a month, while long-term goals might be saving for postgraduate education or investing for your future. Every time you achieve a small goal, you build confidence to aim higher.

Financial Literacy for Students: Financial Literacy 101

Financial literacy is not just about money; it is about freedom, confidence, and control over your future. As a student, the decisions you make today will shape your financial health tomorrow. Learning how to budget, save, invest, and manage debt will make you more prepared for real life than any textbook could.

The world runs on money, and those who understand how it works are the ones who succeed. Start small, stay consistent, and keep learning. Financial literacy 101 is not a one-time lesson—it is a lifelong skill that grows with you.

What is the 50 30 20 Rule for Financial Literacy

The 50 30 20 rule for financial literacy is one of the simplest and most practical ways to manage your money. It helps you divide your income into three clear parts so you can balance your needs, wants, and savings without stress. This rule teaches you how to live comfortably today while also preparing for the future.

Here is how it works. The first 50 percent of your income should go toward your needs. These are the basic things you cannot live without, such as rent, food, transportation, school fees, and utilities. Needs are the essential expenses that must be paid every month to keep your life running smoothly. If your essential costs go beyond 50 percent, it might be a sign that you need to cut back in some areas or find ways to increase your income.

The next 30 percent of your income is for your wants. Wants are the things you enjoy but can live without, like dining out, streaming subscriptions, entertainment, or buying new clothes. It is important to enjoy your money, but in moderation. Spending within this 30 percent keeps your lifestyle fun and balanced while preventing you from overspending on unnecessary items.

The final 20 percent of your income should go directly into savings or debt repayment. This part of the rule focuses on building your financial future. You can use it to save for emergencies, invest for long-term goals, or pay off any loans you have. Saving regularly, even if it is a small amount, creates security and peace of mind. It also helps you prepare for big goals like buying a car, starting a business, or traveling in the future.

The beauty of the 50 30 20 rule for financial literacy lies in its simplicity. It gives you a clear structure to follow, even if you are new to money management. You do not need complex spreadsheets or financial tools—just a little discipline and awareness of how you spend. Many students and young professionals find this rule helpful because it makes budgeting feel natural and not restrictive.

By following the 50 30 20 rule, you learn to prioritize what really matters. It keeps you from spending everything you earn and helps you build the habit of saving regularly. Over time, you will notice that even small savings grow and that having control over your money brings confidence and stability. Financial literacy is not just about earning more; it is about managing what you have wisely, and this simple rule is a perfect way to start.

FAQ Section

1. What is the 50 30 20 rule for financial literacy?

It’s a simple money management plan that divides your income into 50 percent for needs, 30 percent for wants, and 20 percent for savings or debt repayment.

2. Who created the 50 30 20 rule?

The rule was popularized by U.S. Senator Elizabeth Warren and her daughter Amelia Warren Tyagi in their book All Your Worth: The Ultimate Lifetime Money Plan.

3. Why is the 50 30 20 rule effective?

It helps you live within your means, encourages consistent savings, and reduces financial stress by creating a balanced spending structure.

4. Can students use the 50 30 20 rule?

Yes, it’s perfect for students learning financial literacy. It teaches responsibility, helps control spending, and builds the habit of saving.

5. Is the 50 30 20 rule suitable for all incomes?

Yes, but the percentages can be adjusted based on your lifestyle or location. The idea is to maintain balance between needs, wants, and savings.

Frequently Asked Questions (FAQ)

1. What is financial literacy in simple terms?

Financial literacy means understanding how money works. It helps you make smart choices about earning, saving, spending, borrowing, and investing. In simple words, it is knowing how to manage your money wisely.

2. Why is financial literacy important for students?

Financial literacy teaches students how to make responsible money decisions early in life. It helps them learn budgeting, saving, and avoiding unnecessary debt. These habits lead to a stable and secure financial future.

3. How can students start learning financial literacy?

Students can begin by tracking their expenses, creating a small budget, and saving a part of their allowance. Reading financial blogs, watching educational videos, or using budgeting apps can also help them learn more.

4. What is the best way for students to save money?

Start with small, regular savings. Even saving a few dollars each week builds discipline. You can also follow the 50-30-20 rule—50 percent for needs, 30 percent for wants, and 20 percent for savings.

5. Should students invest while studying?

Yes, but only after learning the basics. Students can start with small investments such as mutual funds or index funds. The key is to invest what they can afford and be consistent. Early investing allows more time for money to grow.

6. What is an emergency fund and why is it important?

An emergency fund is money saved for unexpected situations like medical bills or urgent travel. It prevents you from borrowing or using credit cards during emergencies. Every student should aim to build a small emergency fund.

7. How can students avoid debt problems?

Borrow only when necessary, pay bills on time, and avoid using credit cards for luxury items. Always read loan terms carefully and understand the interest rates before borrowing.

8. What is a credit score and how can students build it?

A credit score is a number that shows how well you manage borrowed money. Paying bills on time, using credit cards wisely, and avoiding missed payments help build a good credit score.

9. How does budgeting help students?

Budgeting helps students control their spending and ensures they have enough money for important needs. It prevents overspending and makes saving easier.

10. Can financial literacy really change a student’s future?

Absolutely. Learning about money early builds discipline, reduces financial stress, and opens opportunities for wealth creation. Financial literacy gives students confidence and independence in managing their lives.

Related Article: How to Build a $100,000 Stock Portfolio from Scratch

Leave a Reply