Vanguard vs Blackrock: Let’s be real for a second. Every time we think about investing or want to put some money into the stock market, we end up hearing the same names again and again. Vanguard. BlackRock. Especially Vanguard ETFs and BlackRock iShares ETFs. Almost every financial blog, every YouTube video, and even investment advisors keep mentioning these two brands.

So which one is actually better? Which company gives better returns? Is Vanguard really better because of its low fees? Or does BlackRock take the lead thanks to its global exposure and innovation? And most importantly, as regular investors, should we go with Vanguard or BlackRock ETFs?

Today, I want to talk to you exactly like I would talk to a friend who wants to start investing. No confusing financial jargon. No technical charts. No robotic writing. Just a clear and friendly chat about which ETF company performs better in different situations.

By the end of this article, you will clearly understand

Which company is better for long term investors

Which one is best during market fluctuations

Which ETFs you should consider

Whether fees or market exposure matters more

How to choose between Vanguard and BlackRock ETFs for your personal goals

Let’s settle this once and for all.

Understanding the Basics

What is an ETF anyway

Imagine you want to invest in fifty or a hundred different companies but you do not have enough money or time to buy each one individually. An ETF is like a basket of different stocks or bonds. You buy one share of that ETF and you automatically become a partial investor in every stock inside that basket.

Now Vanguard and BlackRock both create these ETF baskets. They decide what companies or assets to include and then investors like us buy shares of that ETF.

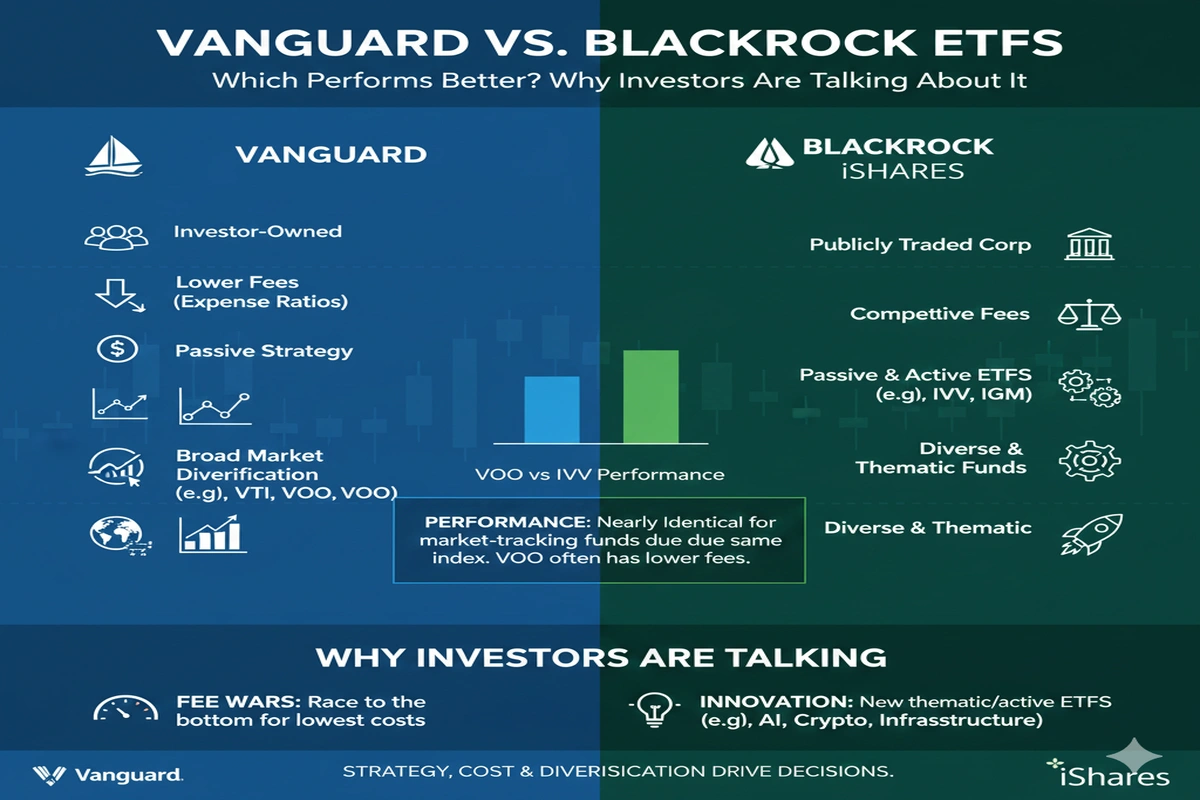

Vanguard is known for long term low cost investing. BlackRock is known for innovation and diversification, especially through its iShares brand.

A Short History So You Know Who You Are Dealing With

Vanguard was founded by John C Bogle in 1975. He believed that most people do not need complicated high fee investments. He invented the index fund strategy which follows the market instead of trying to beat it. Vanguard stayed loyal to this philosophy and that is why investors who want stability and low fees often select Vanguard.

BlackRock was founded in 1988 and it is currently the largest asset manager in the world. They manage trillions of dollars and own the iShares brand which is famous for offering a wide variety of ETFs. BlackRock is seen as more flexible and more likely to adapt quickly to modern financial trends like sustainable investing, sector focused ETFs and global exposure.

So if Vanguard is the old school disciplined investor then BlackRock is the modern investor who likes to diversify and stay ahead of trends.

Vanguard vs BlackRock ETFs Performance

Which one usually performs better

Performance depends on what you define as better. Let me explain it like this.

If your plan is long term wealth growth with lowest fees and minimum risk then Vanguard may perform better because it follows the market steadily and does not try complicated moves.

If you want to take advantage of new sectors such as technology focused ETFs, emerging markets, artificial intelligence and green energy then BlackRock often has more ETF options and may deliver higher returns depending on timing.

Vanguard tends to perform consistently well over time because of passive index following. BlackRock might sometimes outperform in certain years especially when markets shift and new sectors rise.

In simple words Vanguard is like running a marathon steadily while BlackRock sometimes sprints in the middle. Both can win but it depends on your running style.

Fees Comparison

Does the cost really matter

Absolutely Yes. Fees can make a huge difference if you are investing for more than five or ten years.

Vanguard is famous for ultra low fees. Many of its ETFs have expense ratios under zero point one percent. Meaning if you invest one thousand dollars you might only pay one dollar per year as a fee.

BlackRock also has low fees but in many cases Vanguard is slightly cheaper especially for large market index ETFs. However if you choose specialized ETFs from BlackRock like clean energy or international exposure you may pay more.

So long term investors often prefer Vanguard for cost efficiency. But investors who want specific sector based funds may consider BlackRock too.

Investment Style

Passive vs Active in everyday language

Vanguard is mostly passive. Their philosophy is that it is almost impossible to consistently beat the market in the long run. So they simply follow the index like S and P 500 and let compound interest do the job.

BlackRock offers both passive and actively managed ETFs. Active ETFs try to beat the market using predictions and trading strategies. It can work well in certain periods but it also carries risk.

So if you like simplicity choose Vanguard. If you believe in strategy and timing choose BlackRock.

Range of ETFs

Which company offers more choices

BlackRock wins here. Their iShares brand has over eight hundred ETFs globally. They cover almost every possible theme such as cybersecurity ETFs, robotics ETFs, renewable energy ETFs, Asia Pacific ETFs and even very niche investments.

Vanguard has fewer ETF options but they cover all core investment categories like US stocks, global stocks, bonds and sector based funds.

If you want a one stop uncomplicated portfolio Vanguard is enough. If you want advanced diversification BlackRock gives you more variety.

Example Comparison of Popular ETFs

Now let us look at which ETFs are most popular under each company.

Vanguard

VTI Total Stock Market ETF

VOO S and P 500 ETF

BND Total Bond Market ETF

VXUS International Stock ETF

BlackRock iShares

IVV S and P 500 ETF

IEFA Developed Market ETF

IGV Technology ETF

ICLN Clean Energy ETF

Vanguard VOO and BlackRock IVV are both S and P 500 ETFs. Their performance is nearly identical because they track the same index. However VOO usually has slightly lower fees.

But if you want a technology focused ETF BlackRock IGV has historically performed well as long as tech sector is booming.

Which Performs Better During Market Crashes

During market downturns Vanguard tends to hold steady because it focuses more on core index tracking. BlackRock may suffer more if investors hold niche sector ETFs.

For example during the 2020 pandemic crash Vanguard index ETFs dropped less aggressively compared to some high risk specialized ETFs. So if you prefer safety Vanguard has shown better resilience.

Which Performs Better During Bull Markets

In bull markets or when certain sectors like technology or clean energy are booming BlackRock ETFs may outperform because they make it easier for investors to concentrate on those high growth areas.

If you want aggressive growth during strong market conditions BlackRock can shine.

Tax Efficiency

Both companies are highly efficient but Vanguard has a slight edge because it pioneered tax friendly ETF structures.

If you are a US based long term investor planning to hold for several years Vanguard might offer slightly better tax treatment. However BlackRock is very close in this area too.

Which Is More Suitable for Beginners

If you are completely new to investing and want a simple low cost ETF with steady returns then Vanguard is the better choice. Most beginners do not need hundreds of ETF options. They need two or three good funds that track the market consistently.

Vanguard is friendly for people who want to start small and invest regularly.

BlackRock is good if you are already comfortable with basic investing and now want to explore new opportunities.

Which Is Better for Advanced Investors

Advanced investors who like building complex portfolios often prefer BlackRock because it offers ETFs for different sectors, countries, strategies and even commodities.

You could build a detailed portfolio with multiple themes using BlackRock iShares products.

Customer Trust and Reputation

Vanguard is widely respected for putting customers first. They are client owned which means investors who buy into Vanguard funds indirectly own the company. This aligns their interests with customer goals.

BlackRock is a publicly traded company and the largest asset manager in the world. They are trusted for institutional scale and global reach.

So if you want alignment with investors choose Vanguard. If you want global innovation choose BlackRock.

Should You Pick One or Can You Invest in Both

Actually you can invest in both and that is often the best approach.

For example you can hold Vanguard VOO or VTI as your core ETF for mainstream market exposure. Then you can add a BlackRock sector ETF like IGV for technology or ICLN for clean energy if you believe those areas are the future.

This strategy combines cost efficiency and growth opportunities.

How to Choose Based on Your Personality

If you like slow steady growth with minimal hassle go for Vanguard.

If you enjoy exploring investments and occasionally want to bet on high growth sectors choose a mix with BlackRock.

If you are completely confused just start with Vanguard. You can always add BlackRock ETFs later.

A Real Life Scenario to Help You Decide

Let us imagine two friends.

Rahul wants to invest money for retirement and does not want to check his investments every day. He prefers safety. He invests in Vanguard VOO and lets it grow quietly over ten years.

Sneha is also investing for future but she is more informed about technology markets. She puts two thirds of her money in Vanguard VOO for safety and invests remaining one third in BlackRock IGV for tech exposure.

Both strategies make sense based on personality.

My Personal Opinion After Researching Both

Both Vanguard and BlackRock are excellent providers. Neither is bad. But they fit different kinds of investors.

If I had to select only one for pure simplicity I would choose Vanguard because time and compound interest are powerful enough to grow wealth even without aggressive strategies.

But if I have a bit more knowledge and want to target high growth industries I may allocate some money to BlackRock ETFs too.

The best investors often combine the two.

Final Conclusion

Vanguard performs better for long term passive investors looking for low fees and stability.

BlackRock performs better for investors seeking innovation, thematic growth and global diversification.

If your goal is simple long term investing with minimal effort Vanguard is the winner.

If your goal is to capture higher returns by choosing sector based or trend focused ETFs BlackRock can offer more opportunities.

For most people the ideal approach is using Vanguard for the core portfolio and adding selected BlackRock ETFs based on personal interest and risk capacity.

Frequently Asked Questions

What makes Vanguard ETFs popular

Vanguard ETFs are known for very low fees and long term stable performance. They follow simple index tracking strategies which suit investors who prefer passive investing.

Are BlackRock ETFs risky

Not always. While BlackRock offers specialized sector ETFs that may carry higher risk, they also provide low cost passive ETFs similar to Vanguard.

Can I invest in both Vanguard and BlackRock ETFs together

Yes and many smart investors do exactly that. Vanguard for core stability and BlackRock for targeted growth.

Which is better for retirement planning

Vanguard is often preferred for long term retirement investing due to low fees and reliability but adding BlackRock ETFs for extra growth can also be a smart move.

Do ETFs guarantee returns

No investments guarantee returns. ETFs simply provide diversified exposure to markets and sectors. Performance depends on overall market conditions and the ETF type.

Final Words Like I Would Tell a Friend

If you are just stepping into investing do not overthink it. Start with one good Vanguard ETF and set up monthly investments. Once you get comfortable and understand market movements then explore BlackRock ETFs in areas of your interest. You do not need to choose one over the other forever. Think of Vanguard as your long term growth foundation and BlackRock as your opportunity enhancer.

Make informed choices. Stay disciplined. And remember that consistency beats perfect timing.

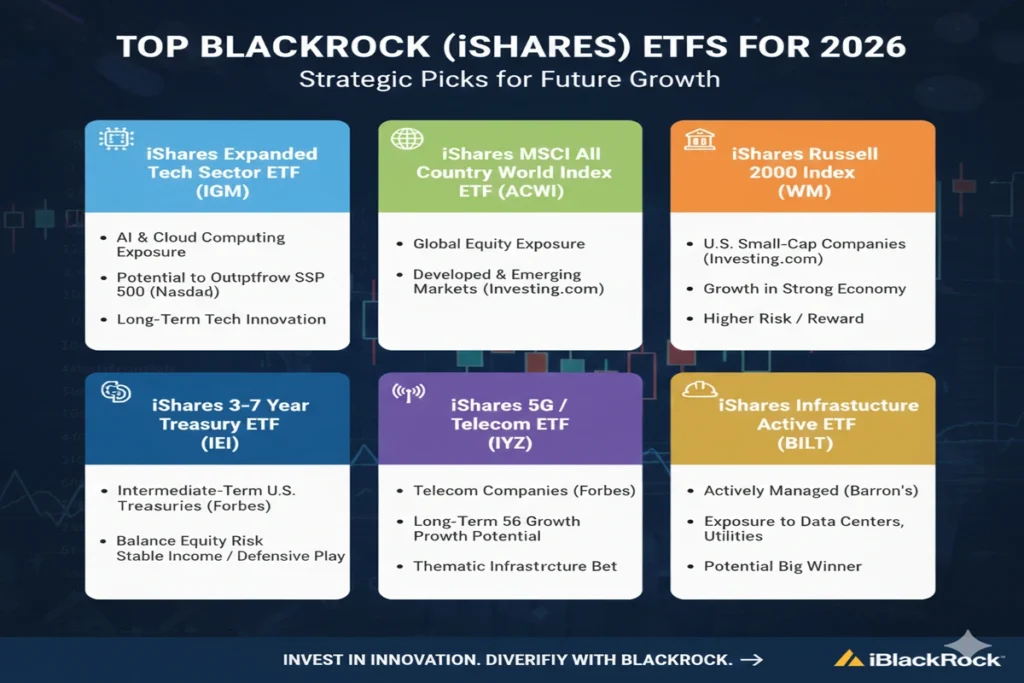

Top BlackRock (iShares) ETFs to Consider for 2026

BlackRock’s iShares ETF lineup is huge and very diverse. Here are some iShares ETFs that could be especially compelling as we move toward 2026:

- iShares Expanded Tech Sector ETF (IGM)

- According to a recent Nasdaq prediction, this ETF could outperform the S&P 500 again in 2026 thanks to its strong exposure to technology and related sectors. Nasdaq

- If you believe in long-term growth from AI, cloud computing, and other tech innovations, this makes a lot of sense.

- iShares MSCI All Country World Index ETF (ACWI)

- Provides global equity exposure, covering both developed and emerging markets. Investing.com

- For investors who want a single ETF to capture global economic trends rather than just U.S. companies.

- iShares Russell 2000 ETF (IWM)

- Targets U.S. small-cap companies. Investing.com

- Small-caps can do well in a growing economy (or when valuations are attractive), but they are riskier — so this could be a “growth plus risk” play.

- iShares 3-7 Year Treasury ETF (IEI)

- A bond ETF from BlackRock, offering exposure to intermediate-term U.S. Treasuries. Forbes

- Useful for balancing equity risk if you want some relatively stable income or defensive positioning.

- iShares 5G / Telecom ETF (IYZ)

- According to Forbes, this ETF offers exposure to telecom companies (Verizon, AT&T, T-Mobile) and could benefit from long-term 5G growth. Forbes

- Good for a thematic bet on infrastructure + telecom innovation.

- iShares Infrastructure Active ETF (BILT)

- BlackRock is launching an infrastructure-focused actively managed ETF. Barron’s

- Infrastructure could be a big winner in coming years (think data centers, utilities, transport) — this ETF gives you exposure with a managed strategy.

Why These ETFs Make Sense for 2026

Here is why these picks actually make sense for 2026, based on macro trends, likely market conditions, and long-term investing strategies:

- Diverse Growth Engines: With tech, small-cap, global exposure, and infrastructure, these ETFs cover multiple growth themes.

- Balanced Risk: Combining equity ETFs (VTI, ACWI) with bond ETFs (IEI) makes a balanced portfolio likely to handle volatility.

- Cost Efficiency: Many Vanguard ETFs mentioned have very low expense ratios.

- Innovation Exposure: BlackRock’s thematic ETFs (tech, infrastructure, telecom) let you access big trends without individual stock risk.

- Long-Term Potential: If you’re investing for 5+ years, these ETFs align with structural trends like digital transformation and infrastructure expansion.

⚠️ Risks to Be Aware Of

Of course, nothing is guaranteed. Here are some risks to consider before buying:

- Market Risk: Tech and small-cap ETFs are volatile.

- Active ETF Risk: Actively managed ETFs (like BILT) depend on manager skill and may underperform.

- Interest Rate Risk: Bond ETFs like IEI lose value if rates go up.

- Global Risk: ACWI exposes you to international markets which can be more volatile or impacted by geopolitical issues.

- Concentration Risk: If you pick thematic ETFs, you might be overweight in a specific sector.

My Suggested ETF Portfolio for 2026 (Based on These Picks)

Here is a sample ETF portfolio you could use for 2026 — think of it like a balanced “starter + growth” mix:

- 40% Vanguard Total Stock Market ETF (VTI) – Core U.S. equity

- 20% iShares ACWI – Global diversification

- 15% Vanguard Small-Cap Value (VBR) – Value + small-cap potential

- 10% iShares Expanded Tech (IGM) – High-growth thematic bet

- 10% iShares Infrastructure Fund (BILT) – Long-term infrastructure play

- 5% iShares 3-7 Year Treasury (IEI) – Defensive / income portion

ETF vs Mutual Fund: Complete Guide for Investors in 2026

FAQ (Unique, Human-Style)

1. Which is better for 2026: Vanguard or BlackRock ETFs?

Both companies offer strong ETFs, but Vanguard is often preferred for long-term investors due to lower fees and broad index tracking. BlackRock iShares ETFs offer more sector-specific and global exposure, which may benefit investors looking for diversification in growth sectors. The best option depends on your risk tolerance and investment goals.

2. What are the best Vanguard ETFs to invest in for 2026?

Some popular Vanguard choices include VTI for overall market exposure, VBR for small-cap growth, and VOO for low-cost S&P 500 tracking. Long-term retirement investors often choose VUG for growth or VXUS if they want exposure to international markets.

3. What are the top BlackRock ETFs for 2026?

BlackRock’s iShares ACWI is ideal for global diversification, while IWF targets large-cap growth stocks. For investors focused on technology, IGV can be a strong candidate. Those seeking emerging market growth may consider IEMG.

4. Which ETF is safer for beginners: Vanguard or BlackRock?

Vanguard tends to be more beginner-friendly due to wide market coverage and lower expense ratios. BlackRock is good for investors who want specific sectors or advanced global positions. Safety depends more on the ETF type rather than the brand alone.

5. Can I invest in both Vanguard and BlackRock ETFs together?

Absolutely. Many investors build their portfolio using a mix from both brands. You could use a Vanguard ETF for core long-term holdings and a BlackRock ETF for specific sector or global exposure to balance risk and returns.

6. Are dividend ETFs from Vanguard and BlackRock good in 2026?

Yes. Dividend ETFs such as Vanguard’s VYM and BlackRock’s DVY are often considered reliable choices for regular passive income, especially in volatile markets.

7. How many ETFs should I hold in my portfolio?

Most long-term investors stick to 3 to 5 ETFs to maintain diversification without overcomplicating the portfolio. Try to cover core market, sector growth, and stability (like dividend or bond ETFs).

Comparison Table: Vanguard vs BlackRock vs Index Funds

| Feature | Vanguard ETFs | BlackRock iShares ETFs | Traditional Index Funds |

|---|---|---|---|

| Best for | Long-term passive investors | Sector, global, and tactical investors | SIP-based long-term growth |

| Expense Ratio | Usually lower (0.03%–0.10%) | Moderate (0.05%–0.50%) | Moderate (0.10%–1.00%) |

| Flexibility | High | Very high | Low (not traded during market hours) |

| Available Markets | Mostly US, some global | Global and sector-diverse | Mostly US benchmarks |

| Trading Style | Buy and hold | Active or strategic investing | Passive lump-sum or SIP |

| Liquidity | Very high | Very high | Medium |

| Minimum Investment | No minimum when using brokerage | No minimum via brokerage | Some funds require $1,000+ |

| Best Options (2026) | VTI, VOO, VBR, VXUS | ACWI, IWF, IGV, IEMG | Fidelity Index Fund, Vanguard 500 Index Fund |

| Dividend Potential | Good (eg: VYM) | Moderate to high | Depends on fund type |

| Risk Level | Low to moderate | Moderate to high | Low to moderate |

| Ideal For | Hands-off investors | Aggressive growth seekers | Long-term SIP investors |

| Tax Efficiency | Very high | Very high | Moderate |

🧠 Quick Recommendation Based on Investor Type

| Investor Type | Best Choice |

|---|---|

| Beginner wanting low-fee and stable growth | Vanguard ETFs (VTI or VOO) |

| Growth-focused investor looking for global exposure | BlackRock iShares (ACWI or IWF) |

| Conservative investor using SIP strategy | Index Funds |

| Passive income focused | Dividend ETFs (VYM or DVY) |

| Aggressive investor targeting tech and emerging markets | BlackRock IGV or IEMG |

Leave a Reply